With the Italian parliamentary election only one week away, polls continue to point to a hung parliament with no clear majority in sight.

However, irrespective of the governing coalition formed after the election, we do not expect the new government to undertake the necessary structural reforms to kick-start the Italian economy.

Instead, most parties have called for higher public spending and such policies would be likely to bring Italy onto a confrontational course with the European Commission over fiscal consolidation and deficit reduction targets at some point. Fiscal profligacy and rising tension with the EU could further heighten market concerns over Italy's debt sustainability, also in light of the possibility of ECB QE purchases ending in 2018, of which Italy has been a large benefactor.

Well, it is seen as at the medium-term Italian debt dynamics under three different political scenarios: the good, the bad and the ugly. In light of a rise in global yields, weak growth prospects and a fragile banking system, it would not take a lot for Italian debt dynamics to worsen.

Overnight (O/N) implied vol for the upcoming Italian election has retraced lower in EURJPY and is now at 3-month lows. In our view, FX options markets complacency and the timing (only one more week to go) make for a good setup to for adding last minute, low downside risk hedges:

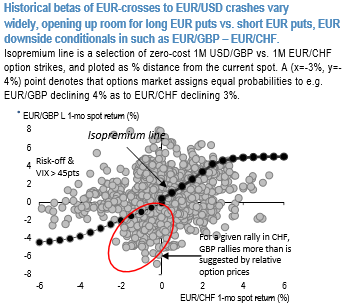

Zero-cost conditional hedges: While the probability of a shocking outcome has declined and the likelihood of a devastating outcome for EUR is deemed low, it seems to us prudent to consider low-cost EUR downside conditionals in the form of long/short EUR puts.

Looking at historical spot return betas of liquid EUR crosses vs. EURUSD during months of sharp EUR declines we find EURCHF to be a notable laggard with a near zero beta due to SNB intervention and our macro analysts expect this cycle to be no different.

While EURJPY demonstrates one of the highest betas the current pricing, especially in OTM, put strikes makes it a less than ideal EUR put candidate.

By contrast, (refer above chart) EURGBP can be paired against EURCHF at near zero cost on equivalent strikes: 1M 2% OTM EURGBP put vs. selling a 2% OTM EURCHF put costs 5bps.

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch