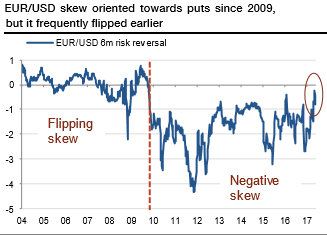

EURUSD risk reversals (RR), which measure the relative appetite of upside and downside strikes, have been oriented towards puts since end-2009 (refer above graph). However, before 2009, EURUSD RR frequently flipped between calls and puts. A negative RR means that the US dollar tends to appreciate faster than it falls, reflecting the durable positive correlation between the dollar’s level and its volatility. This is what happened when the Fed embraced exceptional monetary easing. But the ongoing monetary switch, coupled with choppy exits in both the US and EU, could switch the dollar/vol correlation if the dollar declines in a disordered way. Indeed, EURUSD vega will perform if the terminal fed funds rate peaks lower than expected while the market discounts a tighter ECB, since the 6m vol is strongly correlated with the ECB vs Fed rates spread (refer above graph).

That would result in positive EURUSD risk reversals, or at least put an end to a persisting negative skew, with frequent flips from now on.

While the EURUSD skew stayed negative during the years of super-easy monetary policy, changes in FX skews are not unusual. For instance, the USDJPY 3m RR has traded on the positive side 23% of the time since start-2009, and the EURGBP 3m RR has been on each side exactly 50% of the time over the same period. The EURUSD 3m RR is currently nearly flat, while the 6m and 1y are lower than one vol for EUR puts. Crossing the line whereby euro calls become more expensive than puts may not be that far away.

With alleviating EUR downside risks, and given frequent flips in the EURUSD skew before the Fed/ECB QE era, positive EURUSD risk reversals are an increasingly likely development.

US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms