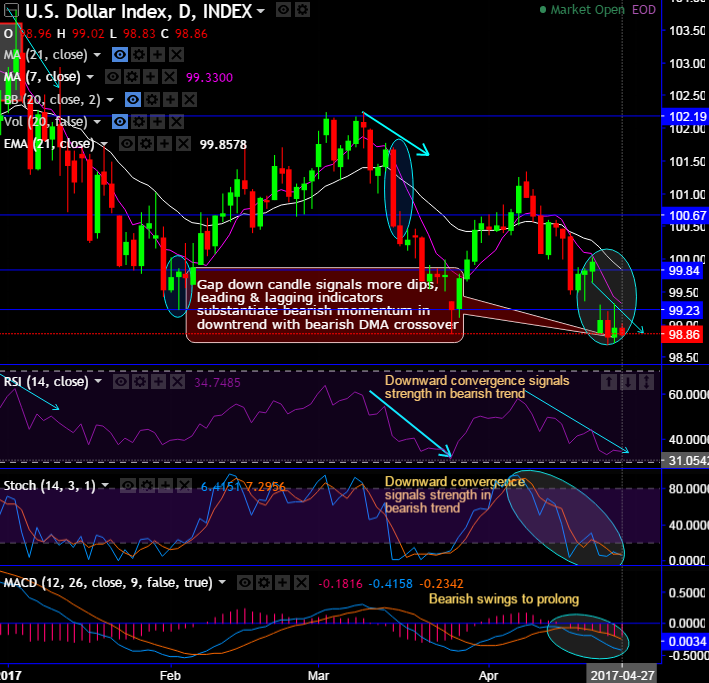

After gap down candle occurred at 98.79 level, the bears have managed to extend the price dips upto the current 98.86 levels (while articulating), yesterday’s rallies have exhausted exactly at 99.33 levels (refer daily chart).

For now, any such upswings are not substantiated by both momentum and trend indicators on this timeframe. Instead, we could see bearish DMA and EMA crossovers on daily and weekly charts.

The US dollar index forms hammer pattern candlestick at 99.84 levels, historically, the bulls test the support at the same levels and the same bullish pattern was occurred to the evidence the upswings, but these upswings were restrained exactly at 7DMAs (refer daily charts).

For now, both leading & lagging oscillators signal momentum & downtrend continuation.

Both RSI and stochastic curves evidence downward convergence with the prevailing slumps.

MACD also signals bearish trend to prolong further.

On a broader perspective, the current prices have slide below 7EMAs, the bearish sentiments are backed up by both RSI and stochastic curves.

Fundamentally, the US administration on the other hand has returned to its tax plans. Treasury Secretary Mnuchin promised last night that there will be far-reaching reforms before the end of the year. The FX market no longer pays much attention to these promises.

Neither had the government so far convinced in other key areas nor do we have sufficient knowledge as to which way the tax reform would go.

While the FxWirePro currency strength index for the dollar has been neutral earlier today in Asian session after a skepticism over Trump’s tax reforming plans, despite relinquishing its gain for the day for the previous week after gaining traction found in bullish pattern as stated above but the overall dollar basket is still weaker.

For more details on our index please visit below weblink:

http://www.fxwirepro.com/fxwire/currencyindex

Trading tips:

Well, as a result of above technical reasoning, on speculative grounds we advise tunnel spreads which are binary versions of debit put spreads.

This strategy is likely to fetch leveraged yields than spot FX and certain yields keeping upper strikes at 99.33 and lower strikes at 98.67 levels.