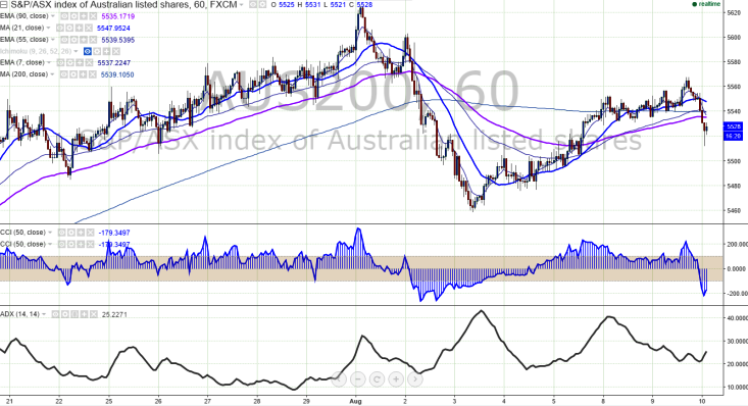

- Major support - 5,560 .

- The index has slightly retreated after making a high of 5568 yesterday .It is currently trading around 5529 The index is trading slightly below 200 HMA a slight decline till 5460 is possible.

- The intraday trend is slightly bearish as long as the resistance 5600 holds.

- Any break above major resistance 5,540 (200 HMA) will take the index to next level till 5600/5625/5,672 (161.8% retracement of 5,431 and 5,041)/5,700 in the short term.

- On the lower side, support is around 5500 and any violation below that level will drag the index till 5450/5400.

It is good to sell on rallies around 5535-5540 with SL around 5,600 for the TP of 5460/5400.