Should hover just above 0.7900 during the day ahead given little data and US markets closed.

AUDUSD in medium-term perspective: The reversal from 0.81 late Jan to 0.78 mid-Feb has removed much of the apparent AUD overvaluation, setting up for more two-way price action in the weeks ahead.

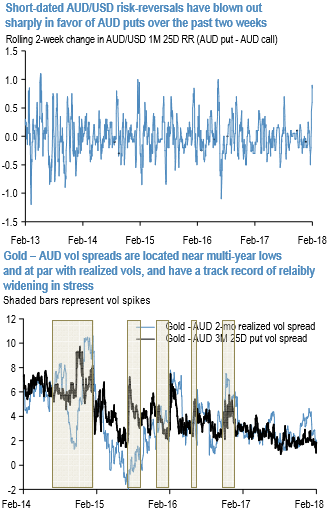

AUD risk-reversals: A 3-sigma move over the past two weeks has taken 1M 25D AUD riskies to their widest in 6-months (1st chart). Anecdotal reports peg the demand for AUD skew to be stemming hedging demand for short variance swaps on dealer books initiated earlier in the year.

It is impossible to benchmark how far the short covering process might have yet to run, but the fact that AUD riskies stalled in the latter half of the week even as CNH and cross-yen vols and skews were blowing out suggests that a good part of the move may be behind us.

As we have flagged on a number of occasions and as many vol investors are well aware, owning AUDUSD skews (delta-hedged) has been one of the most reliable money losers in the post-GFC years since the reduction of RBA cash rates to all-time lows has decimated the erstwhile speculative carry positioning base in the currency and rendered it a pale shadow of its former high beta self, with the result that the much more modest (inverse) spot-vol correlation these days during market disruptions no longer justifies a hefty premium for AUD puts over AUD calls.

Hence this abrupt widening of AUD skews strikes us as an opportunity to sell OTM AUD puts to finance longs elsewhere; one interesting RV set-up along these lines is long gold puts vs. short AUD puts (both legs delta-hedged).

The 2nd chart illustrates that this vol spread is located at multi-year lows, an artifact not only of the recent spike in AUD vols and skews but also still depressed gold vols (one of our favored buys, see note) and skews that remain stubbornly bid for calls. Thanks to gold's much higher risk beta, a gold vs. AUD vol spread has a reliable track record of widening appreciably in stress, and at current levels carries no penalty little or no realized vol penalty to be long. Courtesy: JPM

Currency Strength Index: FxWirePro's hourly USD spot index has shown -81 (which is bearish), while hourly JPY spot index was at 2 (neutral) while articulating at 07:24 GMT. For more details on the index, please refer below weblink:

http://www.fxwirepro.com/currencyindex.

FxWirePro launches Absolute Return Managed Program. For more details, visit:

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise