The Reserve Bank of Australia’s monetary policy is scheduled for this week (on April 2nd). Unusually, this meeting will be on the same day as the announcement of the Federal Budget at 7:30 pm that evening. As such, we would expect that the Governor’s Statement will be fairly low key with little change from the sentiment we saw in the March meeting. So far, the Aussie central bank has maintained status quo to leave rates unchanged.

A change in RBA policy is also a likelihood for the first time in three years, the general consensus is that they are expected to cut rates by 25 bps in this monetary policy. Whether or not there is a cut in May, markets will continue to price in a high likelihood of one later in the year.

Near-term most of the action will be in front-end rates, with the chance for a substantial richening in the event of cut.

For today, AUDUSD opens the session with a bearish gap after the weekend, dropped to a fresh 4-month low at 0.6962, Aussie dented upon risk-aversion. Although the pair has attempted to gain little upside traction momentarily ahead of the above event, more slumps seem to be on cards if the risk-off worsens in Europe.

We will now quickly run you through OTC outlook of AUDUSD, before proceeding further into the options strategic framework.

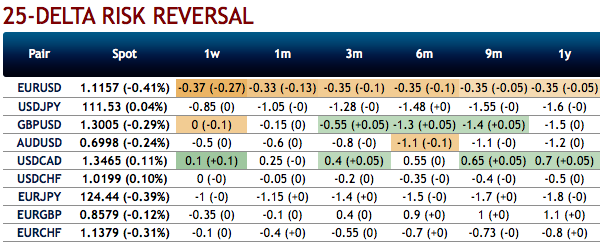

Please also be noted that mounting numbers of negative risk reversals in longer tenors and bearish neutral RRs of the 3m tenors signifies hedging sentiments remain intact for the downside risks (refer 1st(RR) nutshell). In the nutshell, AUD OTC hedgers’ sentiments substantiate that their risk mitigating activities for the downside risks have been clear.

While the positive skewness in IVs of 3m tenors indicates the hedgers’ mounting interests to bid OTM put strikes up to 0.6750 level which is in line with the above bearish scenarios (refer 2nd nutshell).

Contemplating all these factors, diagonal put spreads are advocated to mitigate the downside risks with a reduced cost of the trading objective.

The execution of options strategy: Short 1m (1%) OTM put option with positive theta (position seems good even if the underlying spot goes either sideways or spikes mildly), simultaneously, add long in 2 lots of delta long in 3m (1%) ITM -0.79 delta put options. A move towards the ATM territory increases the Vega, Gamma, and Delta which boosts premium.

The rationale: We have advocated delta long puts for the long term on hedging grounds, comprising of more number of ITM long instruments and theta shorts with narrowed tenors for 1m shrinking IVs to optimize the strategy.

Theta shorts in OTM put option would go worthless and the premiums received from this leg would be sure profit. We would like to hold the same option strategy as stated above on hedging grounds. Thereby, deep in the money put option with a very strong delta will move in tandem with the underlying. Courtesy: Sentrix and Saxobank

Currency Strength Index: FxWirePro's hourly AUD spot index is inching towards -126 levels (which is highly bearish), while hourly USD spot index was at 14 (mildly bullish) while articulating (at 06:42 GMT).

For more details on the index, please refer below weblink: http://www.fxwirepro.com/currencyindex

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  BOJ Policymakers Warn Weak Yen Could Fuel Inflation Risks and Delay Rate Action

BOJ Policymakers Warn Weak Yen Could Fuel Inflation Risks and Delay Rate Action  Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios  Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty

Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty  ECB’s Cipollone Backs Digital Euro as Europe Pushes for Payment System Independence

ECB’s Cipollone Backs Digital Euro as Europe Pushes for Payment System Independence  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  MAS Holds Monetary Policy Steady as Strong Growth Raises Inflation Risks

MAS Holds Monetary Policy Steady as Strong Growth Raises Inflation Risks  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close