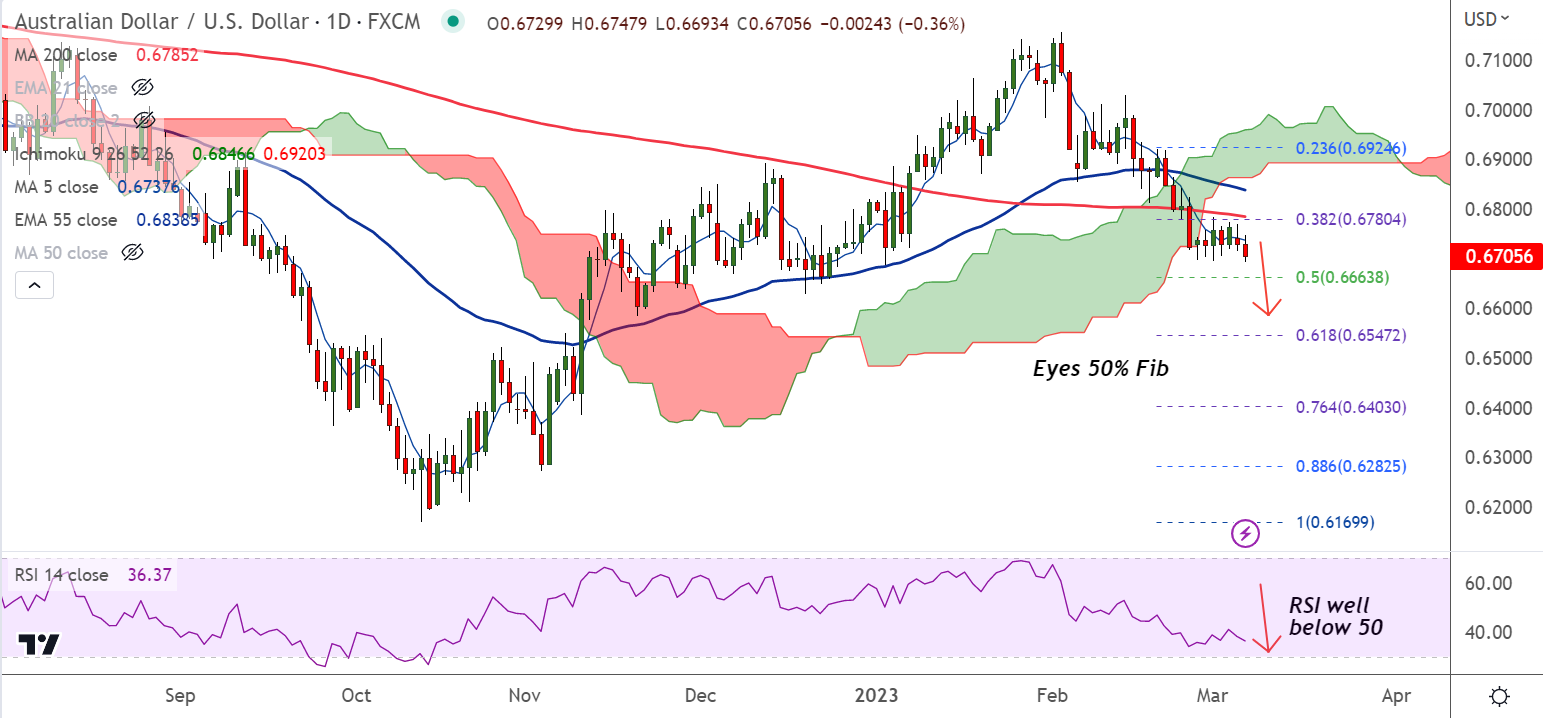

Chart - Courtesy Trading View

AUD/USD was trading 0.30% lower on the day at 0.6710 at around 04:00 GMT, slightly above session lows at 0.6693.

The Australian dollar plunged after the Reserve Bank of Australia (RBA) hiked the benchmark cash rate by 25 basis points.

The move was widely expected after Australia's inflation rose to a three-decade high last quarter.

The RBA raised the cash rate by a quarter percentage point to 3.60% in an attempt to control inflation running at three-decade highs.

The central bank said more work needs to be done to tackle inflation and warning of further tightening.

Australia rate futures are now pricing in RBA cash rate at 4.18%, down from 4.35% a week ago.

Focus is on US Fed Chair Powell’s semi-annual testimony to lawmakers later today and tomorrow. Powell's remarks will be closely watched for further guidance on monetary policy.

In his previous speech last month, Powell emphasized the ‘disinflation’ theme and stopped short of adopting an aggressive tone following a solid US jobs report.

US rate futures are pricing in the Fed’s target rate to peak around 5.48% in September from the current 4.50-4.75%, compared with under 5% at the end of January.

Major Support Levels: 0.6663 (50% Fib), 0.6653 (Lower BB)

Major Resistance Levels: 0.6739 (5-DMA), 0.6785 (200-DMA)

Technical Summary: AUD/USD trades with a bearish bias. Momentum is bearish, volatility is high and rising. GMMA indicator shows minor trend is bearish.

The pair is on track to test 50% Fib at 0.6663. Bearish invalidation only above 200-DMA.