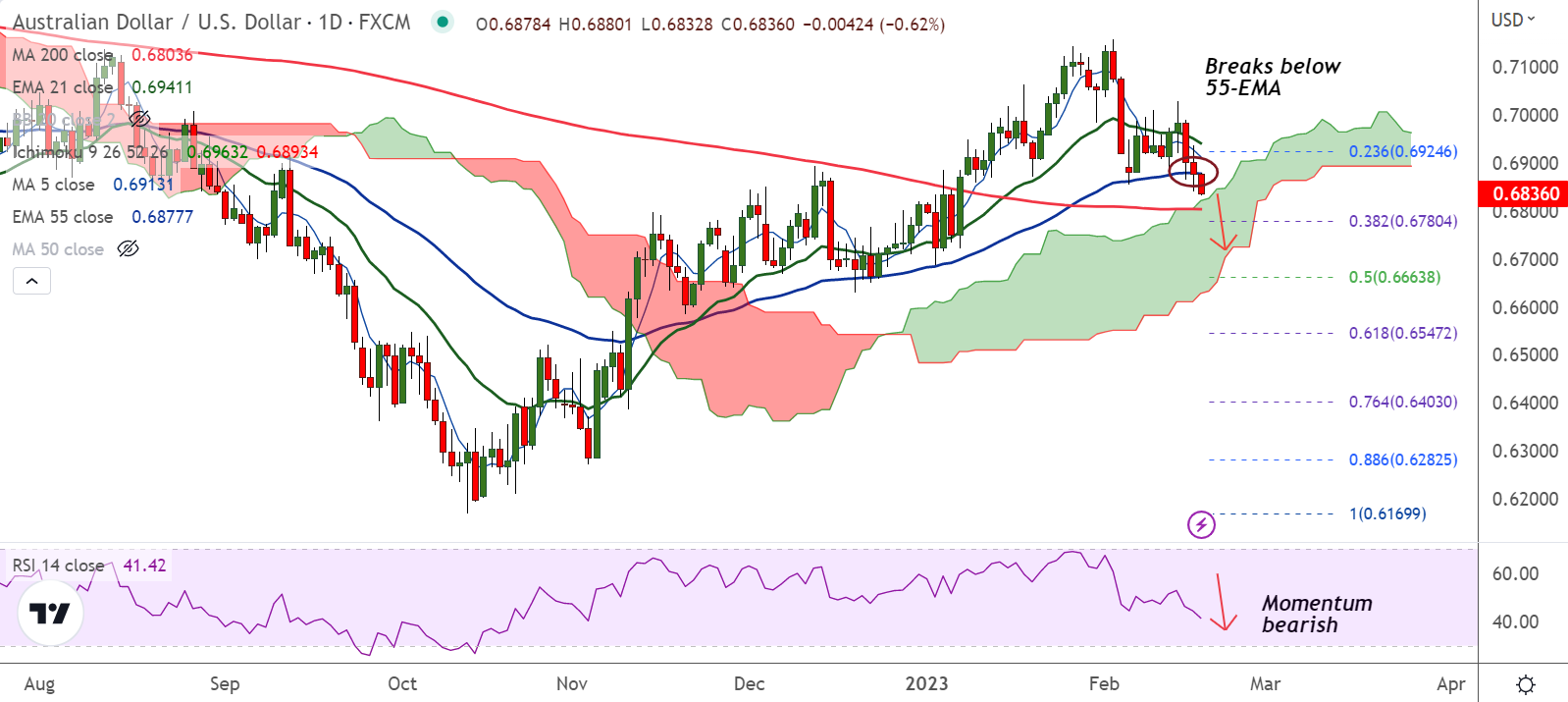

Chart - Courtesy Trading View

AUD/USD was trading 0.59% lower on the day at 0.6837 at around 06:35 GMT, extends weakness for the 3rd straight session.

The pair remains under pressure as hawkish Fed expectations and recession fears underpin the greenback.

Data released overnight showed US Producer Price Index (PPI) for January was up 0.7% MoM after declining 0.2% in December.

Meanwhile, US Initial Jobless Claims for the week ended February 10th, unexpectedly fell to 194,000, compared to the 200,000 expected and 195,000 prior.

Upbeat figures hinted that the Federal Reserve would have to maintain its inflation-fighting interest rate hikes for longer.

Interest rate futures market now shows US rates could peak close to 5.25% by July before dropping to 5.0% by the end of the year.

Technical Analysis:

- AUD/USD has broken below 55-EMA and is on track to test 200-DMA and daily cloud support

- Momentum is bearish, Stochs and RSI are sharply lower, RSI well below the 50 mark

- Volatility is high and rising, Chikou span is biased lower

- GMMA indicator shows minor trend is bearish on the daily charts

Major Support and Resistance Levels:

Support levels - 0.6803 (200-DMA), Resistance levels - 0.6877 (55-EMA)

Summary: AUD/USD trades with a strong bearish bias. Scope for test of 200-DMA at 0.6803. Break below 200-DMA will plummet prices.