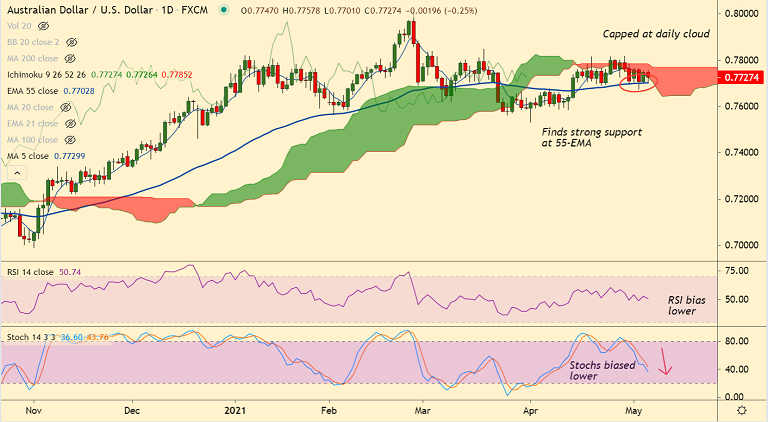

AUD/USD chart - Trading View

Technical Analysis: Bias Neutral, tilted towards the downside

GMMA Indicator

- Major and minor trend is neutral on the daily charts

- Weekly charts shows major trend is bullish while minor trend is turning bullish

Ichimoku Analysis

- Cloud caps gains in the pair

- Chikou span is bias lower, supporting downside

Oscillators

- Stochs and RSI are biased lower

- RSI still holds above the 50 mark

Bollinger Bands

- Volatility is high on the daily charts as evidenced by wide Bollinger bands

- Intraday charts show rising volatility which along with bearish momentum could drag prices lower

Major Support Levels: 0.7702 (55-EMA), 0.7634 (21W EMA), 0.7625 (110-EMA)

Major Resistance Levels: 0.7785 (Upper BB), 0.78, 0.7823 (Upper BB)

Summary: Aussie under pressure after China says to end 'strategic economic dialogue' and "indefinitely suspend" all activities under the China-Australia Strategic Economic Dialogue. Sour market sentiment and the US dollar strength exerting additional pressure on the pair.

Technical indicators are biased lower. MACD shows bearish crossover on signal line. Price action is holding support at 55-EMA at 0.7702, break below will drag the pair lower.