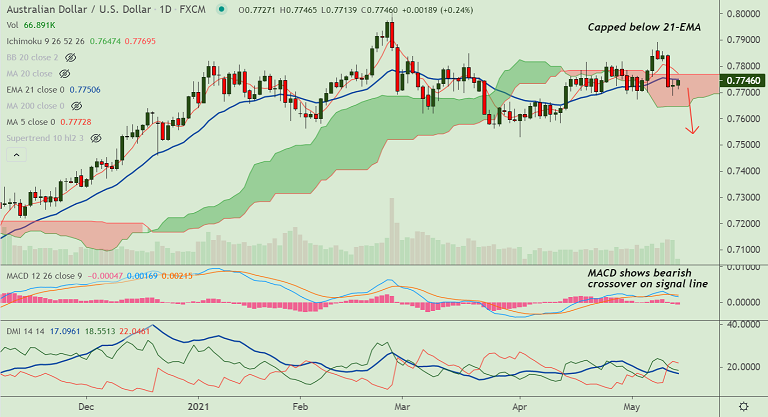

AUD/USD chart - Trading View

AUD/USD was trading 0.05% higher on the day at 0.7730 at around 06:20 GMT.

The pair is extending sideways for the 2nd consecutive session, outlook remains bearish.

GMMA indicator shows major trend is neutral, price action has bounced off 55-EMA support.

MACD is showing a bearish crossover on signal line, price action within cloud, 5-DMA is biased lower.

Oscillator are biased lower, Stochs show bearish momentum. RSI is below 50 mark. Break below 55-EMA will see more weakness.

Focus on US Retail Sales, Michigan Consumer Sentiment Index for impetus. Break below cloud will open downside. Scope for test of 200-DMA at 0.7488.