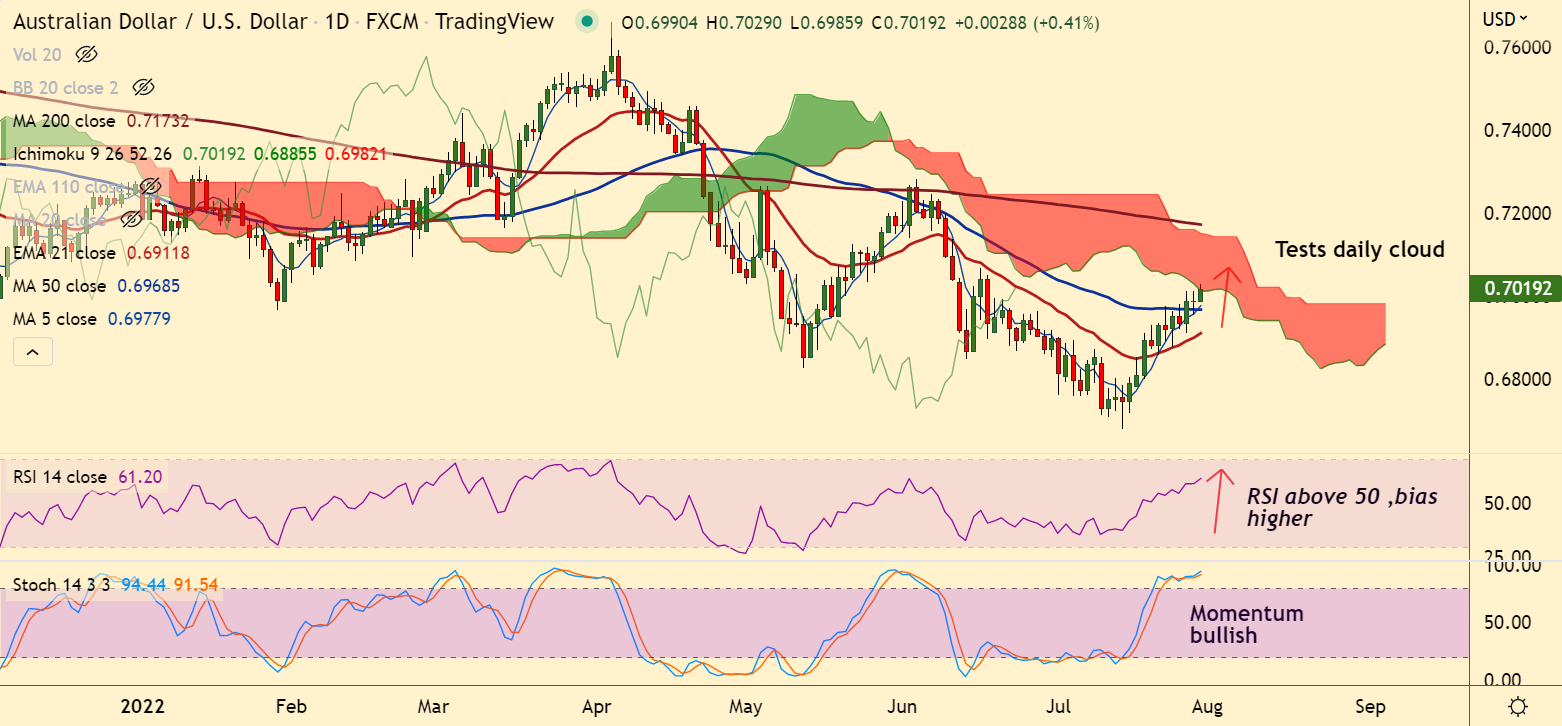

Chart - Courtesy Trading View

AUD/USD was trading 0.41% higher on the day at 0.7017 at around 07:15 GMT.

The pair remains supported higher amid weak DXY and is testing daily cloud base resistance.

The US dollar index (DXY) printed a fresh three-week low of 105.84 and is likely to display more weakness after poor US GDP data renewed recession fears.

US Bureau of Economic Analysis reported on Thursday, US annual Gross Domestic Product (GDP) at -0.9%, missing expectations of 0.5%.

Focus today will be on US Personal Consumption Expenditure (PCE) data, which is seen at 6.7%, higher than the prior print of 6.3%.

On the other side, Reserve Bank of Australia (RBA) interest rate decision, due on Tuesday next week, will be key for Aussie price direction.

Analysts expect RBA Governor Philip Lowe may dictate a third consecutive rate hike of 50 basis points (bps).

Major Support Levels:

S1: 0.6978 (5-DMA)

S2: 0.6969 (55-EMA)

Major Resistance Levels:

R1: 0.7061 (110-EMA)

R2: 0.7173 (200-DMA)

Summary: Technical bias for the pair is bullish. AUD/USD is on track to test 110-EMA resistance at 0.7061. Decisive break above could see gains upto 200-DMA.