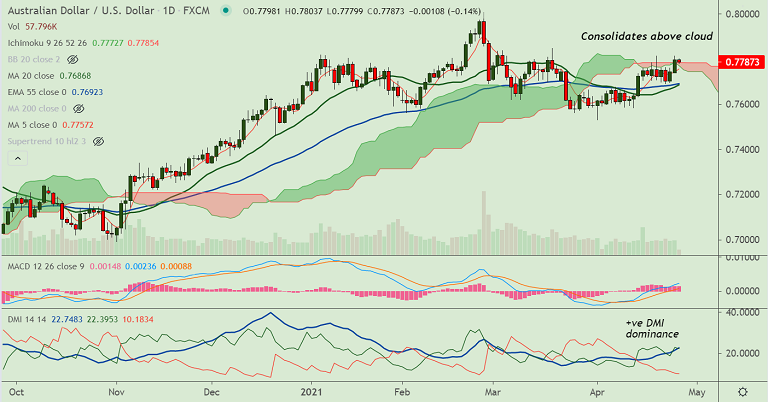

AUD/USD chart - Trading View

AUD/USD was trading 0.16% lower on the day at 0.7785 at around 07:00 GMT.

The major is extending pullback from weekly highs at 0.7815 hit on Monday's trade.

Spike in copper prices buoyed Aussie bulls. Additionally, upbeat market mood adds upside support.

Technical indicators do not provide a clear directional bias. The pair is extending choppy trade around 110-month EMA.

On the data front on Wednesday, Australia first-quarter Consumer Price Index (CPI) data and the Reserve Bank of Australia (RBA) Trimmed Mean CPI figures will be watched closely by market participants.

Later in the day, the FOMC will announce Interest Rate Decision and release the Monetary Policy Statement which could decide further direction for the pair.

Major supports are seen at 0.7757 (5-DMA), 0.7713 (21-EMA), 0.7692 (55-EMA). While resistances are aligned at 0.7815 (double top), 0.7849 (Mar 18 high) and 0.80 (psychological mark).