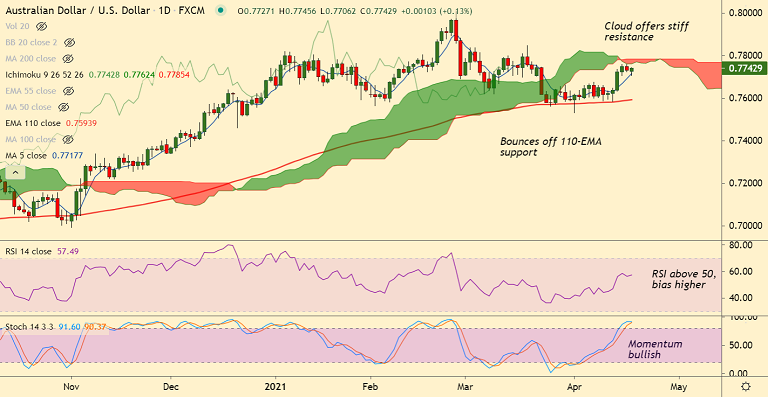

AUD/USD chart - Trading View

AUD/USD was trading 0.12% higher on the day at 0.7742 at around 07:15 GMT, edges higher from session lows at 0.7706.

The pair is extending sideways for the 3rd consecutive session as daily cloud offers stiff resistance. Decisive break above will buoy bulls.

Technical bias is bullish for the pair. Bullish momentum and 5-DMA crossover on 20-DMA add to upside bias.

Data released earlier today showed Australia HIA New Home Sales rose 90.3% month-on-month in March from 22.9% in the previous month.

That said, rising geopolitical risks keep sentiment sour and limit gains in the the risky assets like the Aussie.

Break above daily cloud will buoy bulls in the pair. Next immediate hurdle lies at 0.7837 (Upper W BB).

On the flipside, 5-DMA is immediate support at 0.7717. Break below will see some weakness. Bullish invalidation only below 21W EMA.

Focus on the risk catalysts for fresh impulse ahead of tomorrow’s monetary policy meeting by the People’s Bank of China (PBOC) and the minutes of the latest RBA meeting.