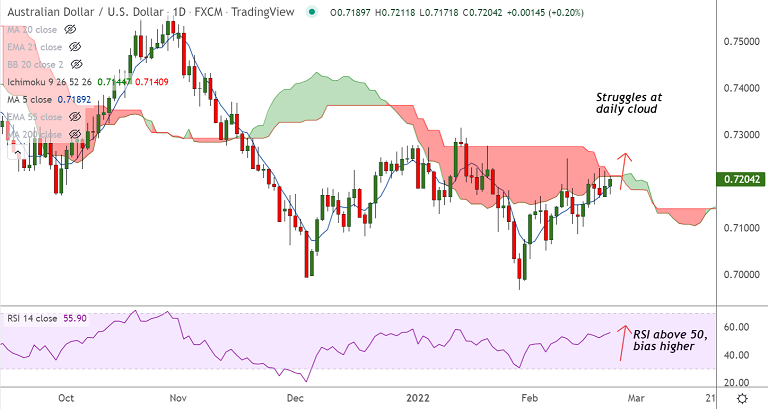

Chart - Courtesy Trading View

AUD/USD was trading 0.18% higher on the day at 0.7203 at around 06:05 GMT, after closing 0.25% higher in the previous session.

The risk-sensitive Australian and New Zealand dollars traded under pressure as traders weigh the Ukraine crisis.

Risk sentiment sours after Kremlin said that there were no concrete plans for a summit over Ukraine between the Russian and US presidents.

The conflict over Ukraine appeared to worsen after Putin signed a decree that recognizes Donetsk and Luhansk in Eastern Ukraine as independent states.

Technical bias is tilted higher, momentum is with the bulls and volatility is high. MACD supports gains.

Preliminary readings of February US PMIs due later on Tuesday will be crucial for further direction after the recently softer Fedspeak.

The pair is extending gains for the 4th straight week, break above daily cloud will propel the pair higher.