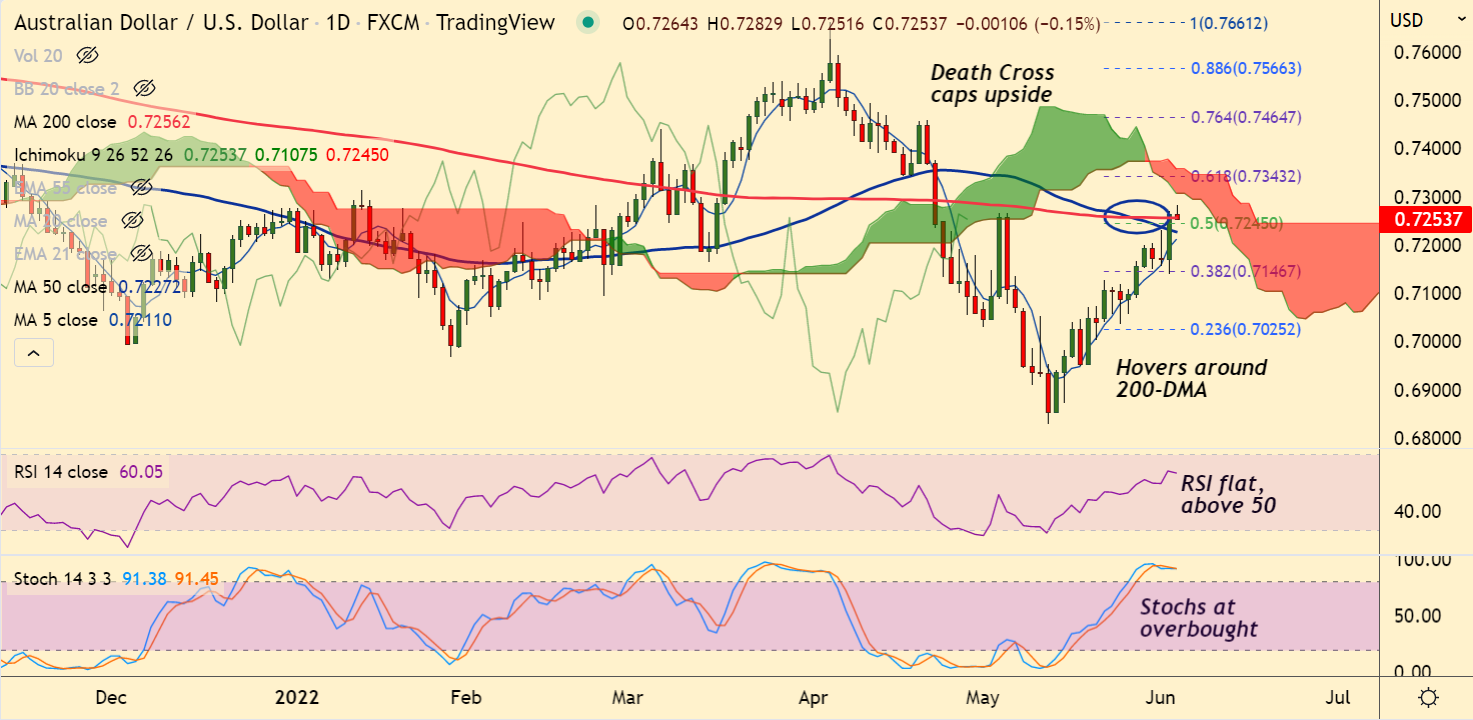

Chart - Courtesy Trading View

AUD/USD was trading 0.07% lower on the day at 0.7258 at around 05:45 GMT. The pair is consolidating previous session's surge, hovers around 200-DMA resistance. Mixed Australia data and cautious sentiment ahead of US NFP keeps upside in the pair limited. A 25 basis point rate hike by the the Reserve Bank of Australia is fully priced in by the markets at its June 7 meeting.

Data Released:

Australia’s AiG Performance of Construction Index eased to 50.4 versus 55.9 in May.

Aussie Home Loans and Investment Lending for Homes for April, down -5.8% and -4.8% versus 0.9% and 2.9% respective priors.

Australia’s Services PMI for May rose beyond the 53.0 expected and previous readings to 53.2. Composite PMI also grew to 52.9 from 52.5 prior.

On the other side, US Initial Jobless Claims, on the other hand, dropped to 200K compared to 210K anticipated and 211K prior.

US Factory Orders for April softened to 0.3%, from a revised 1.8% in March and 0.7% forecast.

Technical Analysis:

- Death Cross on the daily charts limits upside

- Stochs are at overbought levels, scope for reversal

- 200-DMA is stiff resistance, price action struggling to break out

- GMMA indicator shows major trend is neutral, while minor trend is bullish

Major Support Levels:

S1: 0.7222 (110-EMA)

S2: 0.7211 (5-DMA)

Major Resistance Levels:

R1: 0.7256 (200-DMA)

R2: 0.7307 (Cloud base)

Summary: AUD/USD pivotal at 200-DMA. Technical indicators are inconclusive. Break out above will propel the pair higher. US NFP data awaited for impetus.