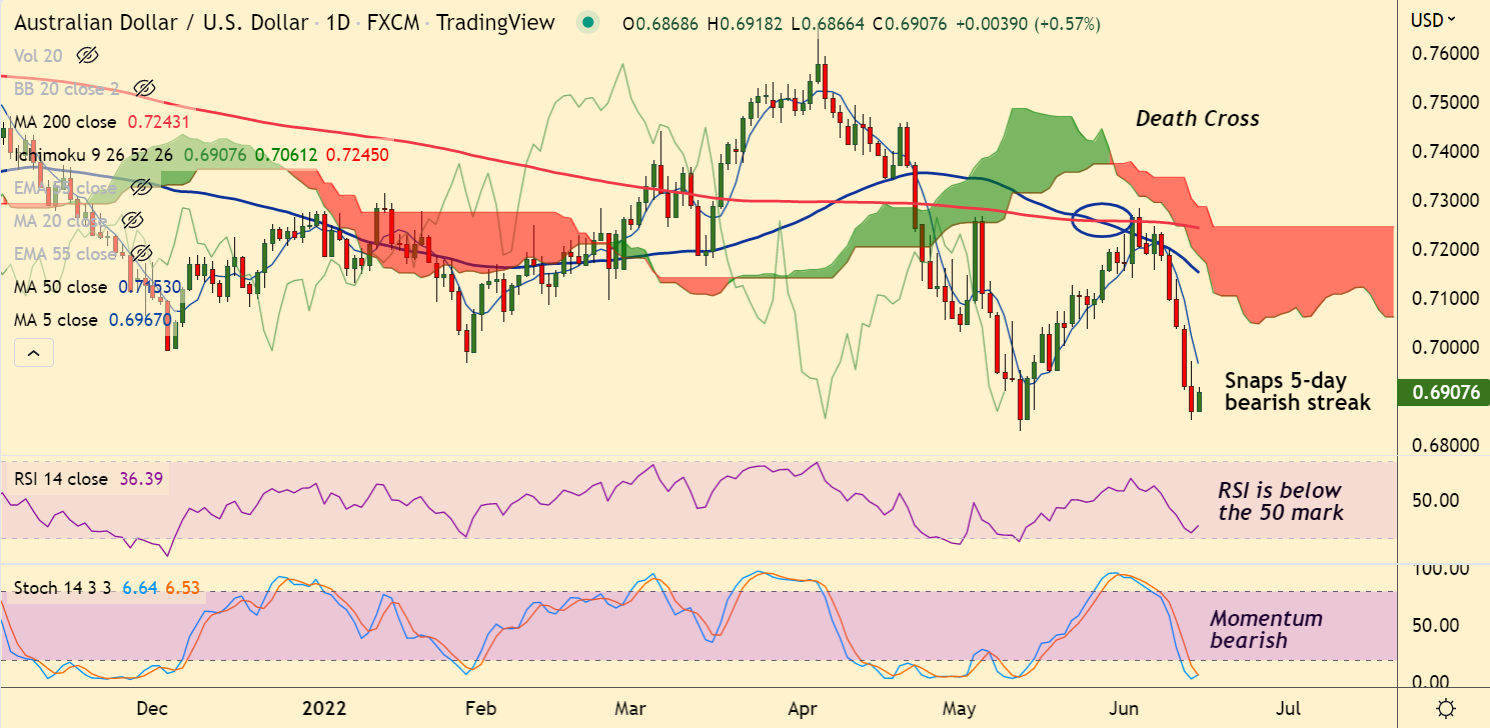

Chart - Courtesy Trading View

AUD/USD was trading 0.60% higher on the day at 0.6910 at around 06:45 GMT.

The pair has snapped a 5-day bearish streak and has edged higher after Aussie found support following upbeat China data dump.

Data released earlier on Wednesday showed China’s Retail Sales improved to -6.7% versus -7.1% expected and -11.1% prior while the Industrial Production reversed -0.7% forecast with 0.7% expansion during May.

Meanwhile, Australia’s Westpac Consumer Confidence for June dropped more than expected -0.7% market forecasts to -4.5%, versus -5.6% prior.

Recent upbeat Aussie fundamentals seemed to support the Reserve Bank of Australia’s (RBA) aggression, favoring AUD/USD bulls.

Technical indicators still favour downside in the pair. Oversold oscillators may cause some pullbacks, but upside is likely to be limited.

Major Support Levels:

S1: 0.6892 (Lower BB)

S2: 0.6828 (May low)

Major Resistance Levels:

R1: 0.6967 (5-DMA)

R2: 0.7076 (21-EMA)

Summary: AUD/USD trades with a bearish bias. Upticks can be used to accumulate shorts. The pair is on track to refresh yearly low below 0.6828.