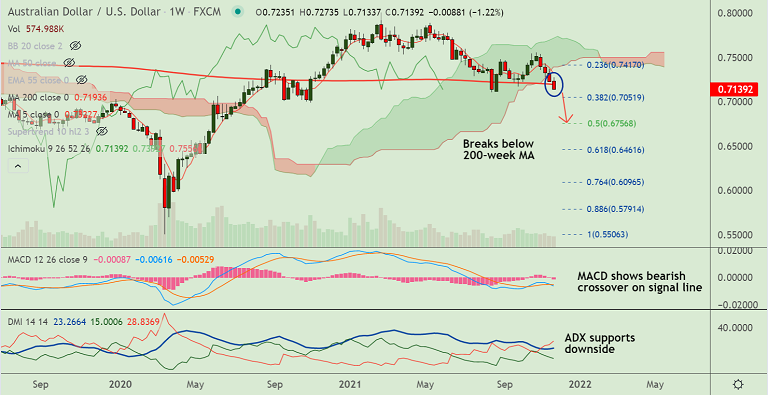

Chart - Courtesy Trading View

AUD/USD was trading 0.67% lower on the day at 0.7140 at around 05:45 GMT, outlook bearish.

Australia Retail Sales crossed 2.5% market consensus and 1.3% prior reading in October to jump with a 4.5% YoY print.

The Reserve Bank of Australia (RBA) has already shown its intent to “wait and watch” before hiking rates and upbeat data failed to impress Aussie bulls.

The antipodeans were subdued amid coronavirus-led risk aversion which is in full swing. Fresh coronavirus woes emanating from the Eurozone keep sentiment sour.

Technical bias has turned bearish after the major has shown a break below 200-week MA. Volatility is high and momentum is strongly bearish.

Major Support Levels:

S1: 0.7105 (Yearly low)

S2: 0.7051 (38.2% Fib)

Major Resistance Levels:

R1: 0.7193 (200-DMA)

R2: 0.7290 (21-EMA)

Summary: AUD/USD is trading with a strong bearish bias. Weekly close below 200-week MA will open downside. Scope for test of 0.70 levels.