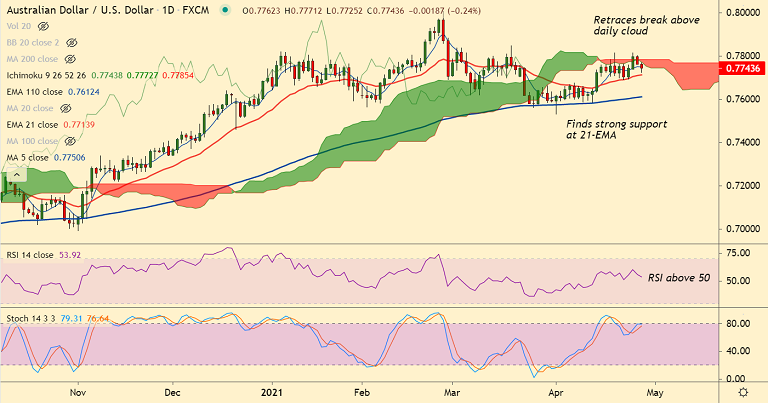

AUD/USD chart - Trading View

AUD/USD was extending previous session's weakness, slips further below 5-DMA after Aussie CPI miss.

The major was trading 0.27% lower on the day at 0.7741 at around 04:05 GMT, after closing 0.46% lower in the previous session.

Data released earlier today showed Australia’s Q1 CPI dropped below 0.9% forecast and prior to 0.6% QoQ while also staying below 1.4% market expectations to 1.1% on YoY.

Further, RBA Trimmed Mean CPI follows the suit while staying below forecasts and previous readouts.

Sluggish moves likely to continue amid pre-Fed trading lull. Covid woes from Asia and uneven vaccinations in the West to weigh on the mood.

Earlier in the day, global rating agency Fitch cites downside risk for Aussie credit markets on stimulus withdrawal.

Technical indicators show minor weakness in the pair. Strong supports are aligned at 21-EMA at 0.7713 and 55-EMA at 0.7693.

Major trend on the weekly charts is bullish. Pullbacks are likely to be shallow. Decisive break above cloud will confirm upside resumption.