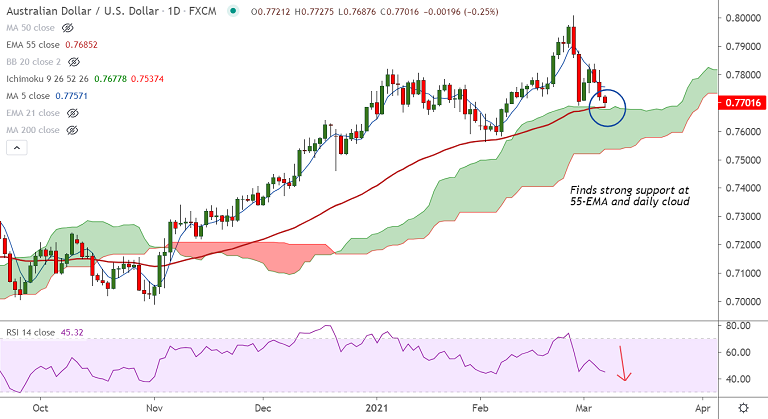

AUD/USD chart - Trading View

AUD/USD plunges to 3-week lows below 0.77 handle, hovers above strong support at 0.7685.

Treasury yields soared as Powell tried to ignore bond bears at his speech overnight, pushing the dollar higher across the board.

AUD/USD is extending previous session's losses and was trading 0.29% lower on the day at 0.7698 at around 02:20 GMT after closing 0.68% lower in the previous session.

Italy’s blockage of the AstraZeneca vaccine for Australia also weighs on the pair. Italy termed Aussie “non-vulnerable” under new EU controls.

Upbeat prints of Australia Trade Balance and AiG Performance of Services Index couldn’t lift the AUD.

Reflation risks are likely to keep the AUD/USD depressed during pre-NFP trading lull. Headline Nonfarm Payrolls (NFP) are expected to rise to 182K while the Unemployment Rate is likely to remain unchanged at 6.3%.

AUD/USD risks further downside if price action breaches strong support at 0.7685 (nearly converged 55-EMA and cloud top). Focus of NFP data for impetus.