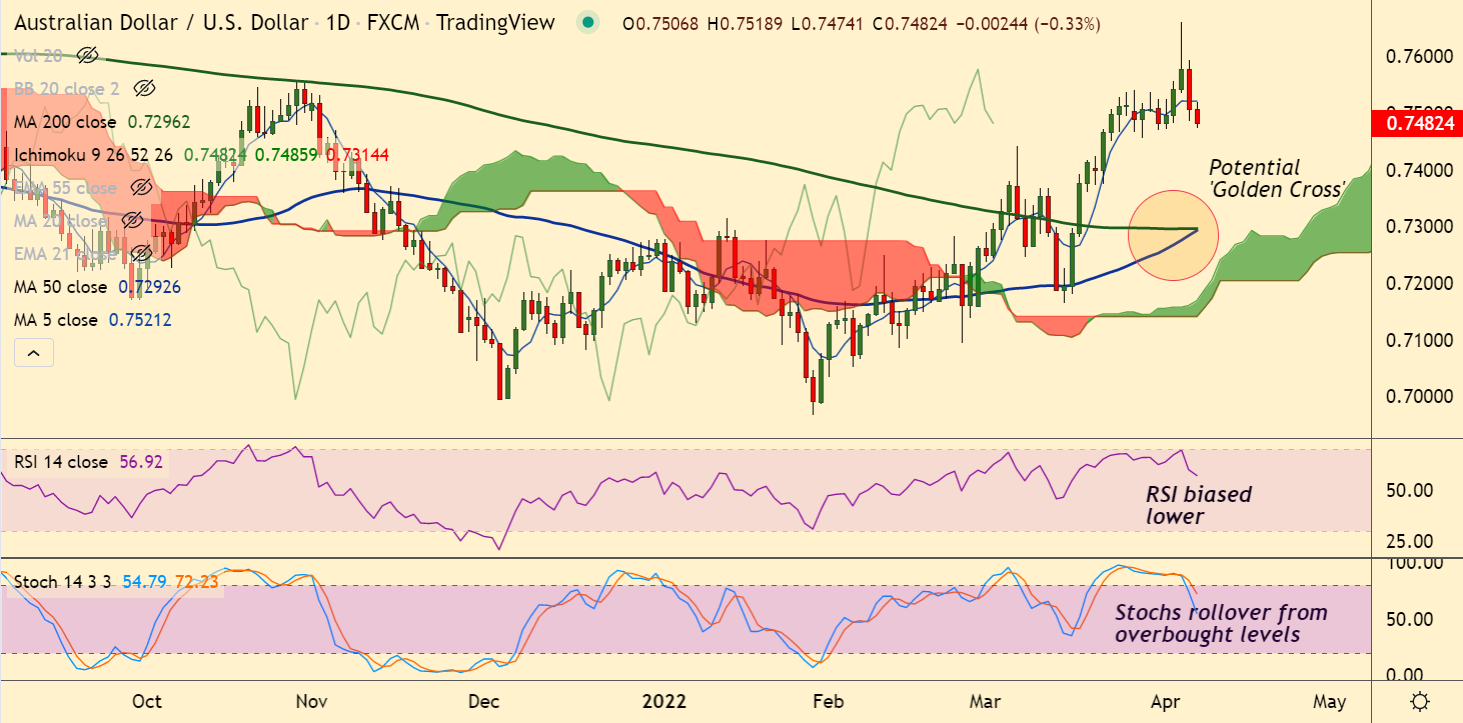

Chart - Courtesy Trading View

AUD/USD was trading 0.28% lower on the day at 0.7485 at around 06:20 GMT.

The pair has slipped below 5-DMA and 200H MA support, scope for further weakness.

Australian dollar holds the lower ground on mixed Australian Trade data and risk-aversion.

Fed minutes overnight signaled plans for over $1 trillion a year balance sheet reduction while raising the rates alongside.

On the data front, Australia's Trade Balance for February printed at 7.46bn AUD vs. 12bn AUD expected and prior 12.891bn AUD.

Also, escalating tensions over the Russian invasion of Ukraine are keeping investors away from higher-yielding assets such as the aussie.

Technical analysis show some weakness in the pair, while major trend still remains bullish. Scope for dip till 21-EMA at 0.7445.

Major Support Levels:

S1: 0.7445 (21-EMA)

S2: 0.7436 (20-DMA)

Major Resistance Levels:

R1: 0.7520 (200H MA)

R2: 0.7629 (110-month EMA)

Summary: AUD/USD was trading with a bearish bias. Price action was rejected at 110-month EMA. Dip till 21-EMA at 0.7445 likely.