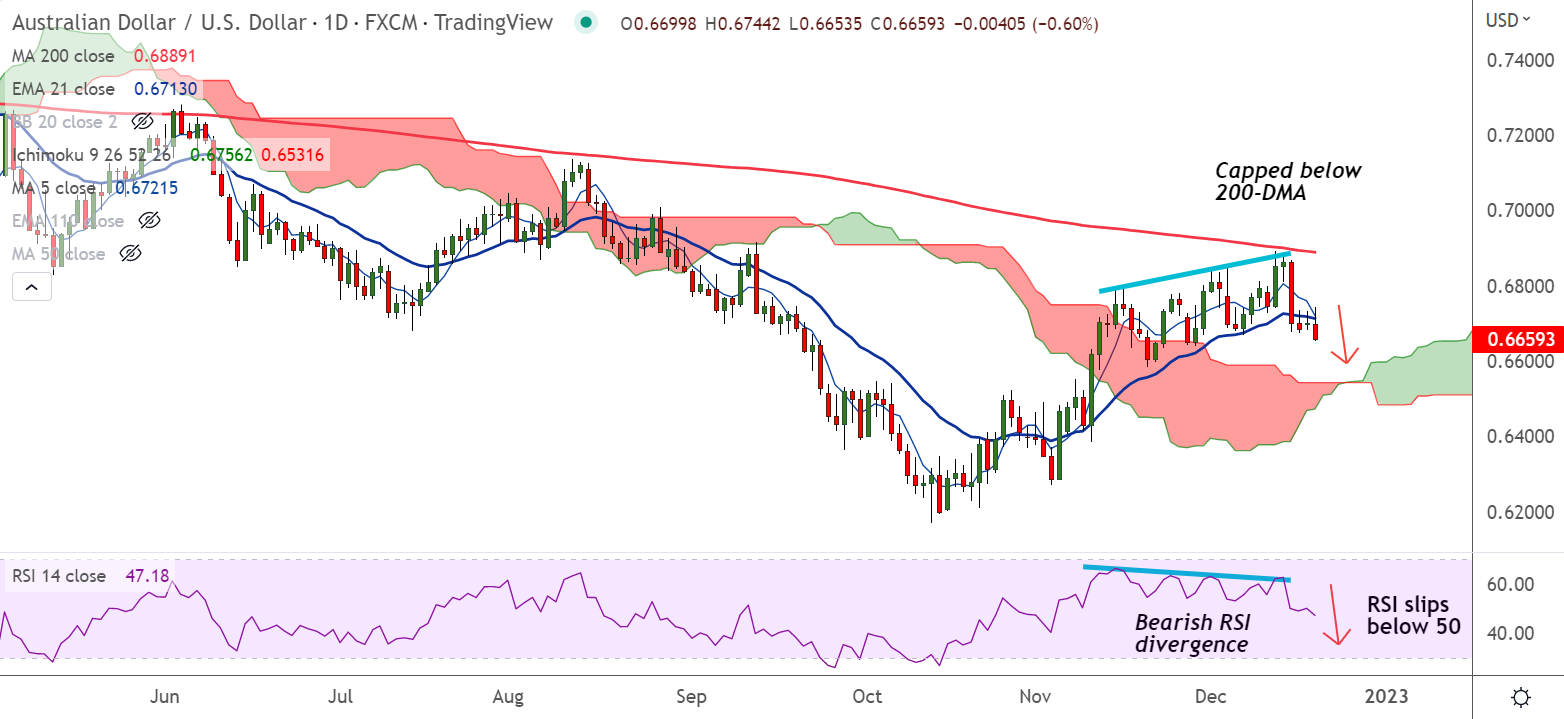

Chart - Courtesy Trading View

Spot Analysis:

AUD/USD was trading 0.93% lower on the day at 0.6637 at around 05:25 GMT.

Previous Week's High/ Low: 0.6893/ 0.6675

Previous Session's High/ Low: 0.6732/ 0.6682

Fundamental Overview:

The People's Bank of China kept the one-Year Loan Prime Rate unchanged at 3.65%, as expected.

Further, the World Bank in the "World Bank China Economic Update - December 2022", reduced China's 2023 GDP forecast to 4.3% from 4.5%.

Aussie extends weakness amid poor China GDP forecasts and a sharp rally in the US Treasury yields.

The hawkish Fed outlook and downbeat US economic data-induced recession fears continue to keep investors on the edge.

Technical Analysis:

- AUD/USD breaks below 55-EMA

- Bearish 5-DMA crossover on 20-DMA adds to the downside bias

- Momentum is bearish, volatility is high and rising

- MACD and ADX support downside in the pair

Major Support and Resistance Levels:

Support - 0.6619 (Lower BB), 0.6543 (Cloud top)

Resistance - 0.6711 (21-EMA), 0.6741 (20-DMA)

Summary: AUD/USD technical bias has turned bearish on the daily charts. Rejection at 200-DMA and bearish RSI divergence add to the downside bias. The pair is on track to test daily cloud.