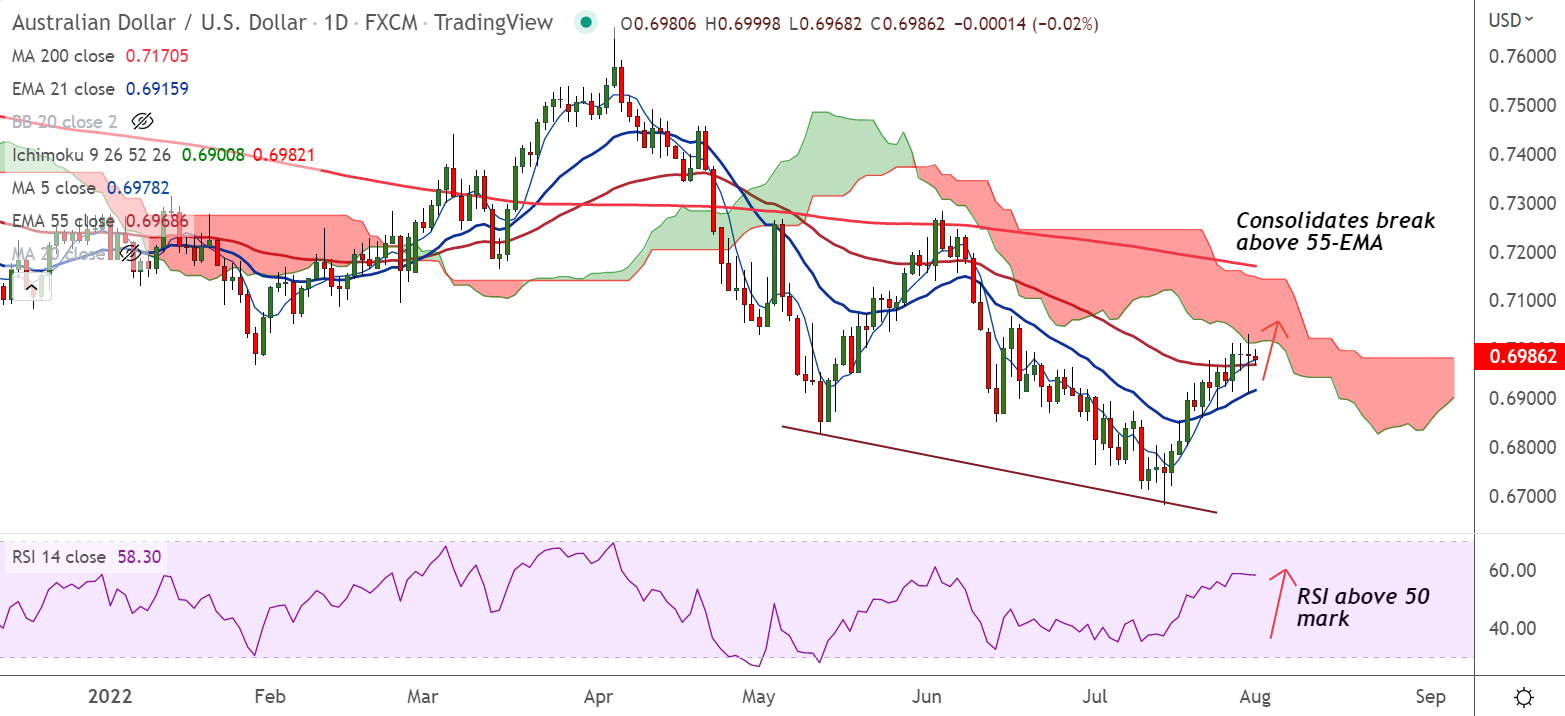

Chart - Courtesy Trading View

AUD/USD was trading in a narrow range with session high at 0.6999 and low at 0.6968.

China’s Caixin Manufacturing PMI printed softer than expected in July, tracking the official NBS Manufacturing, weighing on the antipodeans.

Data released earlier on Monday showed China’s Caixin Manufacturing PMI for July eased to 50.4 versus 51.5 expected and 51.7 prior.

During the weekend, China’s official NBS Manufacturing PMI slipped back into contraction after the previous monthly improvement, down to 49.0 versus 50.4 expected and 50.2 prior.

Further, the Non-Manufacturing PMI rose past 52.3 market forecast to 53.8, against 54.7 in previous readouts.

Also, final prints of Australia’s S&P Global Manufacturing PMI confirmed the 55.7 mark but the prior readings were revised upwards to 56.2.

Mixed PMIs and US-China tussles probe buyers in the pair which is likely extending sideways grind above 55-EMA support.

Break below 55-EMA will drag the pair lower. Resumption os upside will see test of cloud base resistance.

Major focus for this week will be the monthly U.S. jobs report due on Friday. Later in the day, attention turns towards the US ISM PMI data for direction.