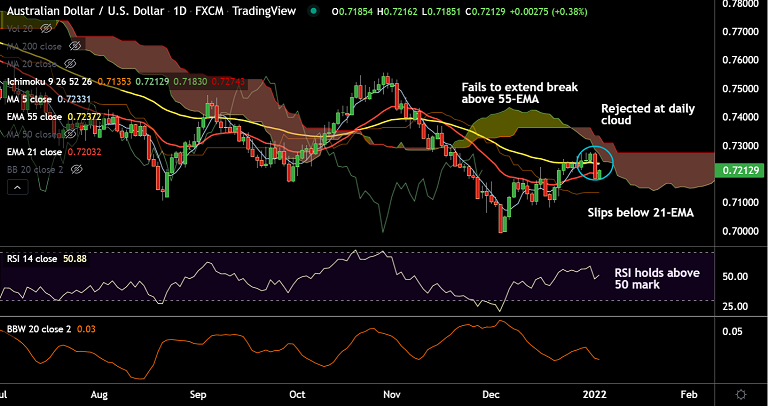

Chart - Courtesy Trading View

AUD/USD was trading 0.39% higher on the day at 0.7213 at around 06:00 GMT.

The pair is extending some gains on the day after China Caixin Manufacturing PMI rose past market forecasts in December.

Data released earlier on Tuesday showed China’s Caixin Manufacturing PMI crossed 50.0 market consensus and 49.9 prior levels to print 50.9 level in December.

That said, worsening virus conditions at home and abroad keep risk appetite sour and check further gains in the pair.

Focus on US ISM Manufacturing PMI for December due later today in the NY session. PMI is expected at 60.2 versus 61.1 prior.

Major attention will be on the FOMC meeting minutes for Fed rate-hike concerns and also virus updates for further impetus.

Major Support Levels:

S1: 0.7187 (20-DMA)

S2: 0.7173 (200-week MA)

Major Resistance Levels:

R1: 0.7236 (55-EMA)

R2: 0.7301 (110-EMA)

Summary: Technical analysis for the pair shows major trend is bearish. Recovery was rejected at daily cloud and 55-EMA resistance, raising scope for resumption in weakness.

Price action has slipped below 21-EMA and is hovering around 20-DMA support at 0.7187. Break below 20-DMA will see more downside. Next major support lies at 200-week MA at 0.7173.