Intraday charts suggest the pair sensing bearish trend and it still remains intact as the leading indicators such as RSI (14) and stochastic are bearish bias.

%D line crossover above 80 levels signifies the overbought pressure while RSI (14) evidences the downward convergence with falling prices, (currently RSI trending at 54.7267). Falling prices are in conformity with substantial volumes as well.

On speculating basis we recommend buying binary put options for targets upto 15-25 pips with ease.

But on hedging front we look at buying credit put spreads even though downtrend seems to be intact but some recovery signs are popping up on EOD as well as weekly charts. RSI and stochastic showing signs of strength in the bullish momentum.

We prefer bull put spreads over calls on hedging perspectives because puts have been estimated with premium prices as the pair has been in downtrend from long while.

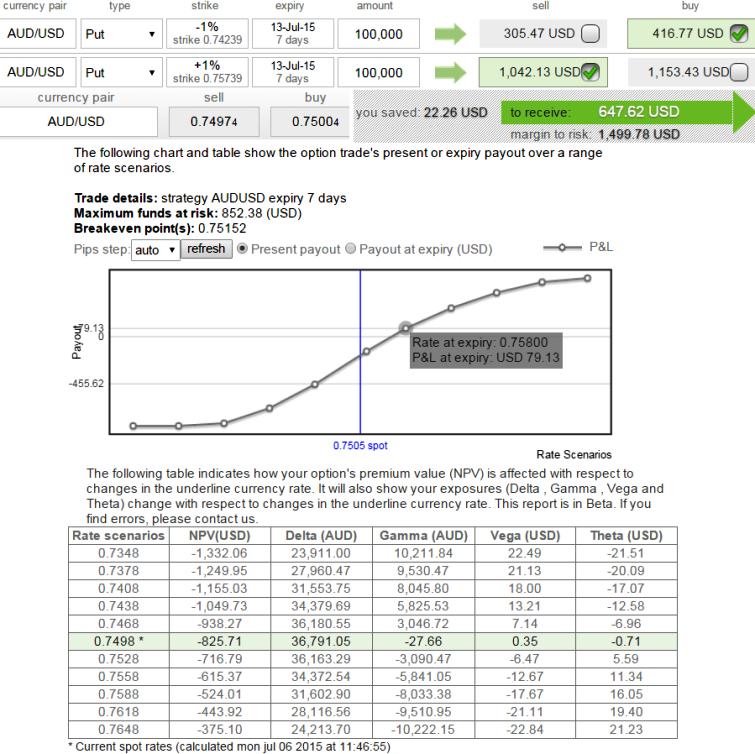

Short 7D (1%) In-The-Money put option positive theta and long on (-1%) Out-Of-The-Money -0.31 delta puts of the same maturity for a net credit. The combined position should have 0.35 delta and slightly negative theta.

Max returns can be achieved to the extent of net premium received - commissions paid.

And it is achieved when the price of underlying exchange rate >= strike price of short side.

FxWirePro: AUD/USD leading indicators suggest sell binary puts but credit spreads for hedging

Monday, July 6, 2015 6:23 AM UTC

Editor's Picks

- Market Data

Most Popular

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate