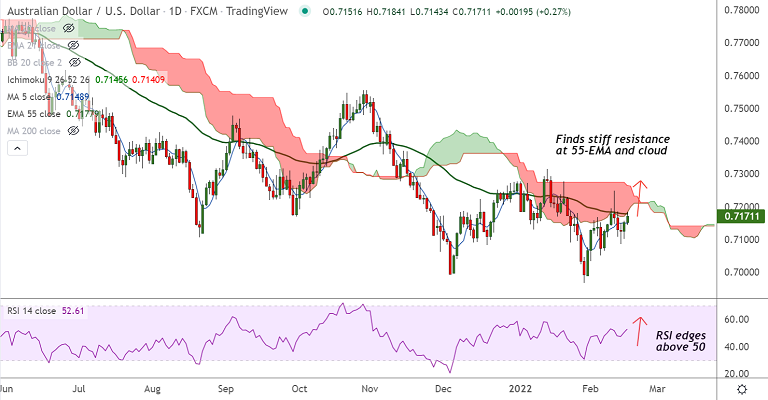

Chart - Courtesy Trading View

Spot Analysis:

AUD/USD was trading 0.27% higher on the day at 0.7170 at around 10:55 GMT.

Previous Week's High/ Low: 0.7248/ 0.7065

Previous Session's High/ Low: 0.7156/ 0.7101

Fundamental Overview:

De-escalation in the Russia-Ukraine tussles after Moscow rolled back some of its troops from borders buoys antipodeans.

On the data front, China’s headline Consumer Price Index (CPI) missed 1.0% YoY forecasts with 0.9% print, versus 1.5% prior.

Further, the Producer Price Index (PPI) also declined to 9.1% YoY compared to 9.5% market consensus and 10.3% prior.

Technical Analysis:

- AUD/USD price action has broken above 21-EMA

- The pair is testing 55-EMA and daily cloud resistance

- Price action is above 200H MA

- Momentum indicators are bullish, RSI is above the 50 mark

Major Support and Resistance Levels:

Support - 0.7145 (21-EMA), Resistance - 0.7177 (55-EMA)

Summary: AUD/USD pivotal at 55-EMA and daily cloud resistance. Focus on US Retail Sales and FOMC minutes for impetus. Break above 55-EMA required for upside continuation.