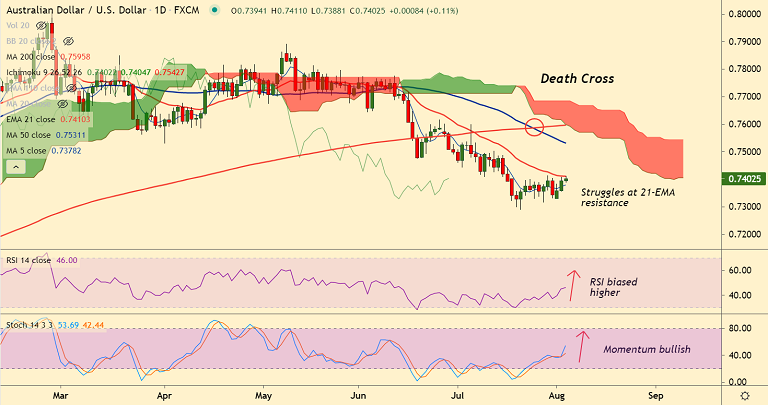

AUD/USD chart - Trading View

AUD/USD was trading 0.12% higher on the day at 0.7402 at around 05:30 GMT, outlook bullish.

The pair is extending gains for the 3rd straight session, struggles at 21-EMA resistance, decisive break above will fuel further upside.

Rising outbreaks of the highly contagious Delta variant in China and their potential impact on economic growth keep markets wary.

U.S. dollar weakness supports upside in the pair. The global dollar index DXY fell below 92.00 mark.

Dovish remarks last week by Jerome Powell, the chairman of the U.S. central bank, on interest rate hikes being "ways away" had sent the dollar lower to hit monthly lows.

Technical indicators show scope for minor gains, but major trend remains bearish. Rejection at 21-EMA could see downside resumption.

Focus shall be on the ADP Employment Report due later in the day that could set the stage for the much anticipated U.S. non-farm payroll numbers on Friday.