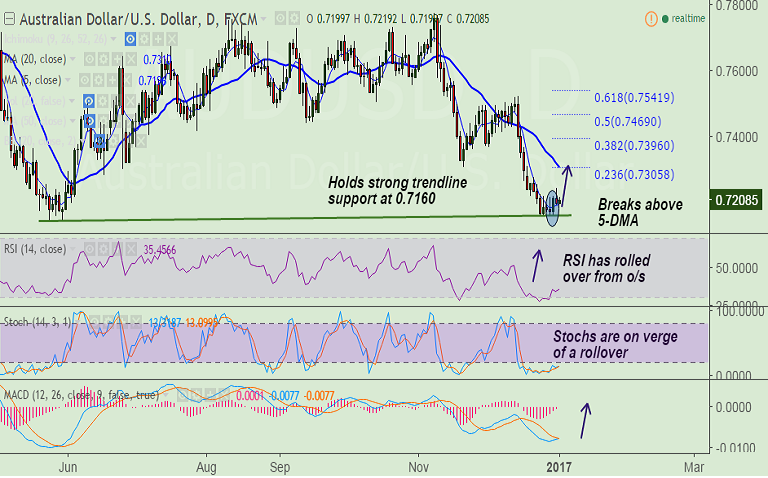

Technical Analysis:

- AUD/USD is holding above 5-DMA support at 0.7196.

- Major trendline support seen at 0.7160, weakness only on break below.

- RSI has shown a rollover from oversold levels. Stochs are at oversold and rollover will support upside bias.

- Price action moving away from lower Bollinger band.

Fundamental Factors:

- Aussie ignores weaker-than-expected official Chinese manufacturing and services PMI reports published over the weekend.

- Higher copper prices combined with broadly weaker Greenback keep the pair supported.

- Persisting weakness in the US treasury yields continue to underpin demand for the emerging market currencies.

Important Levels:

- Support: 0.7196 (5-DMA), 0.7160 (major trendline), 0.7148 (May 30 low)

- Resistance: 0.7258 (Dec 22 high), 0.7305 (23.6% Fib), 0.7325 (20-DMA)

Call Update: We had advised a long in our previous call (http://www.econotimes.com/FxWirePro-Watchout-for-AUD-USD-close-above-5-DMA-at-07185-for-upside-potential-467668).

Recommendation: TP1 achieved. Hold for further gains. Weakness only on close below 5-DMA.

FxWirePro: AUD/USD holds above 5-DMA as Aussie ignores weak China PMIs

Monday, January 2, 2017 4:51 AM UTC

Editor's Picks

- Market Data

Most Popular