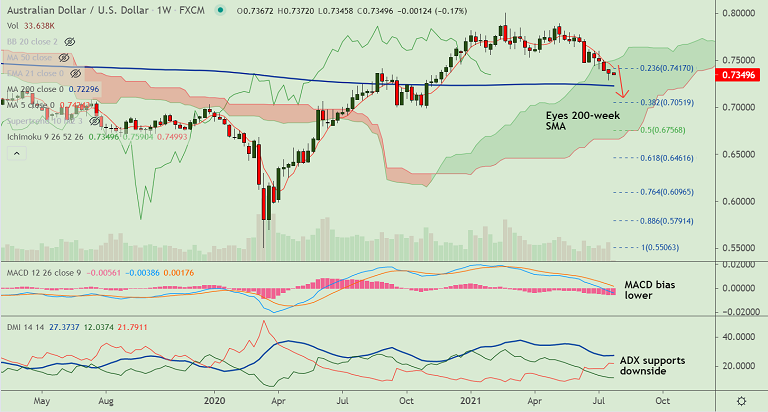

AUD/USD chart - Trading View

AUD/USD opens the week on a bearish note, investors turn pessimistic after China's technology sector crackdown.

The major was trading 0.19% lower on the day at 0.7348 at around 04:25 GMT, extending Friday's weakness.

US-China bilateral talks will be watched as tensions run high after Beijing imposed sanctions on seven Americans ahead of the bilateral talks.

Looming covid worries in Australia add to the bearish pressures for the pair as the nation sees no relief from the Delta covid variant flareups.

US New Homes Sales data will provide some fresh trading impetus. Wednesday’s FOMC decision will be the key event for the week.

The Fed is likely to shed some light on tapering, possibly in the final quarter of this year. Any hawkish hints will drag the pair lower.

Technical bias for the pair is bearish. Major supports on the downside lies at 21-month EMA at 0.7318 ahead of 200-week MA at 0.7229.

Break below 200-week MA will open downside. On the flipside, 200H MA is capping recovery attempts. Decisive break above could see some upside.