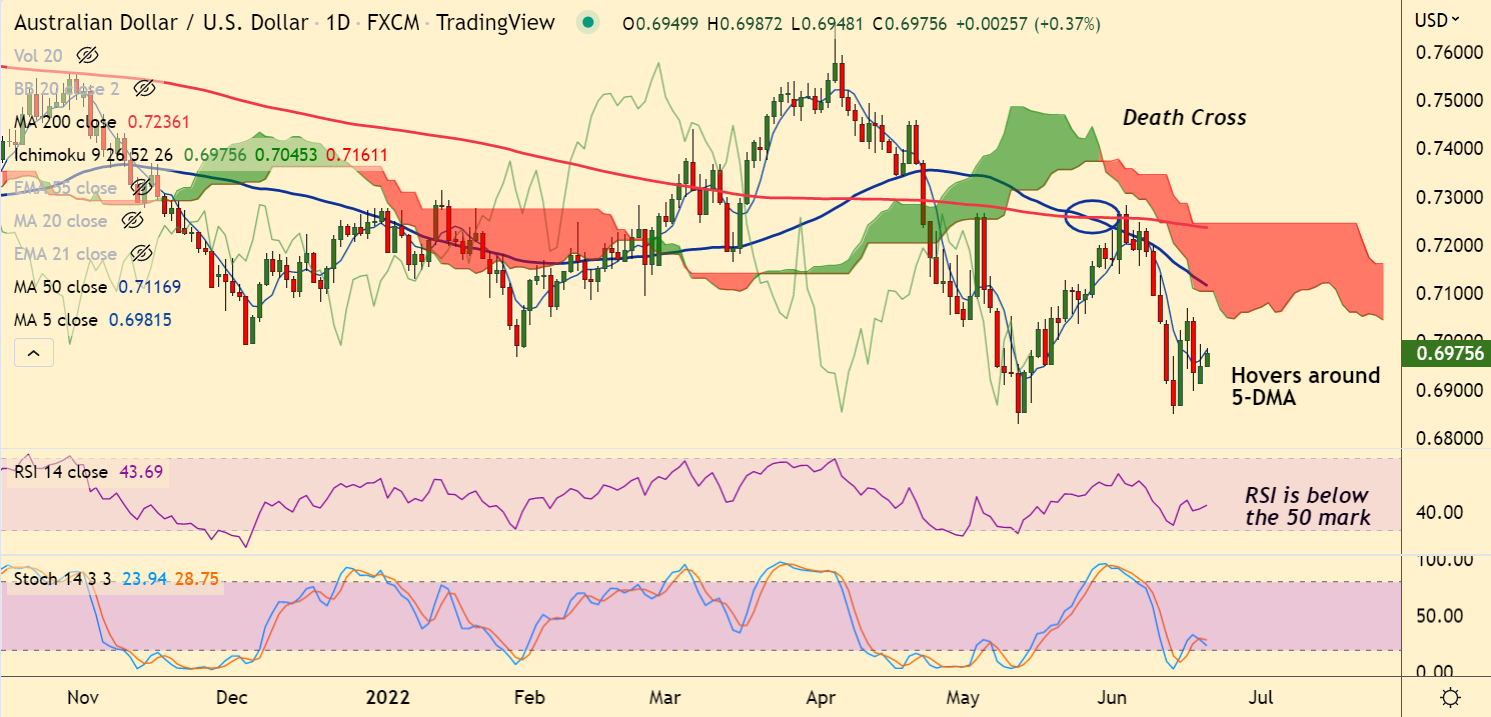

Chart - Courtesy Trading View

AUD/USD was trading 0.37% higher on the day at 0.6975 at around 08:55 GMT

The pair is extending gains for the 2nd straight session, approaches 200H MA resistance

A rebound in the positive market sentiment has supported the antipodeans.

On the other side, uncertainty over Fed Powell’s testimony has kept the dollar index under pressure.

Traders focus will be on the guidance to be provided by Powell on upcoming monetary policy action.

Technical bias for the pair is turning slightly bullish. 5-DMA has turned. Price action edges closer to 200H MA resistance.

Major Support Levels:

S1: 0.69

S2: 0.6862 (Lower BB)

Major Resistance Levels:

R1: 0.6995 (200H MA)

R2: 0.7050 (21-EMA)

Summary: AUD/USD was trading with a major bearish bias, with signs of minor bullishness on the intraday charts. 21-EMA is major resistance at 0.7050, any bullish continuation only on break above.