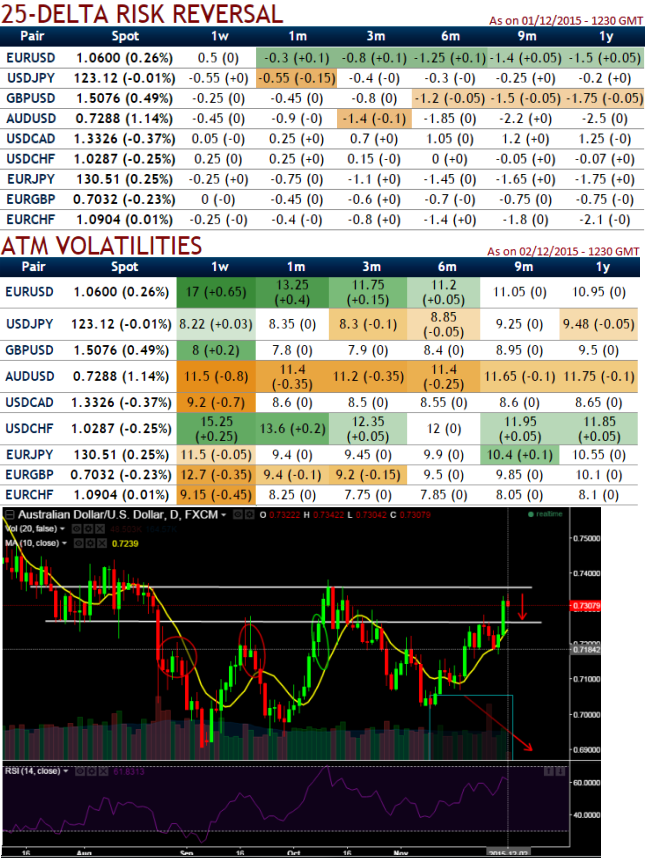

As you can make out from the table the implied volatility for near month at the money contracts of AUDUSD pair has still been on higher side among G20 currency segment in the long run and is perceived to be at 11.5-11.75% levels.

25-delta risk of reversals of AUDUSD is also the most expensive pair to be hedged for downside risks as it indicates puts have been over priced. This is the highest in the long run which would mean that the current downtrend to prolong.

Considering the above aspect we recommend deploying one touch binary puts in our strategy in order to extract leverage on extended profitability.

Thus, on a long term hedging perspective, debit gamma put spreads are advocated so as to reduce the sensitivity and focus on hedging motive.

At current spot FX ticking at 0.7317, Selling 1W out of the money call option is recommended to reduce the cost of hedging by financing long position in buying 1M out of the money gamma put options as the selling indications are piling up on daily graph.

So, buy 1M (-1%) out of the money 0.11 gamma put option and short 1W (1%) out of the money call option.

In the instance that we described above, let's suppose in next 1 week or 10 days time or so AUDUSD declines about 60-100 pips (i.e 0.7249 areas - 1%) put instrument becomes in the money and its Delta increased from -0.25 to -0.5, Gamma is responsible for this change.

Gamma controls the Delta. It is the mathematical formulae software that decides the change in Delta based on a 1 point change in the underlying value.

FxWirePro: AUD/USD gamma calendar combination to hedge downside risks

Wednesday, December 2, 2015 7:54 AM UTC

Editor's Picks

- Market Data

Most Popular