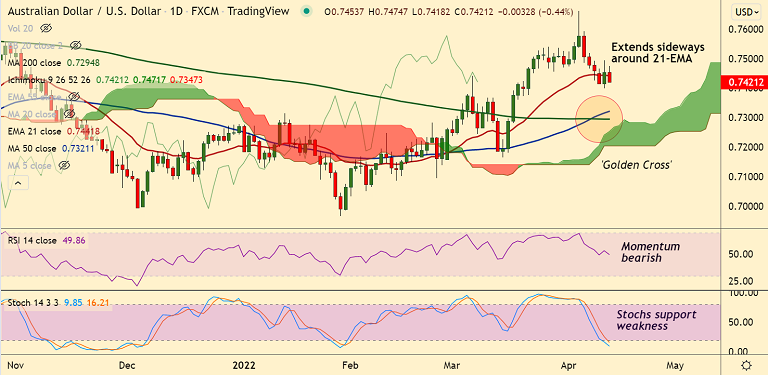

Chart - Courtesy Trading View

Spot Analysis:

AUD/USD was trading 0.40% lower on the day at 0.7424 at around 09:55 GMT.

Previous Week's High/ Low: 0.7661/ 0.7426

Previous Session's High/ Low: 0.7493/ 0.7399

Fundamental Overview:

US dollar remains buoyed across the board, with the DXY holding above 100.00, keeping lid on the pair's upside.

High US inflation (at 8.5%) has raised the odds of a 50 basis point (bps) interest rate hike by the Federal Reserve in its May monetary policy.

Fed Vice Chair Lael Brainard said on Tuesday that the reduction in the balance sheet could start as early as June.

Additionally, Richmond Fed President Thomas Barkin argued that they should quickly get interest rates up to a level where borrowing costs will no longer be stimulating the economy.

On the data front, the Producer Price Index (PPI) from the US due later in the NY session will be looked upon for fresh impetus.

Technical Analysis:

- AUD/USD extends sideways along 21-EMA support

- Price action has slipped below 200H MA

- Bearish 5-DMA crossover on 20-DMA adds to the downside bias

- Momentum is bearish, Stochs and RSI are sharply lower

Major Support and Resistance Levels:

Support - 0.7353 (55-EMA), 0.7315 (110-EMA)

Resistance - 0.7441 (21-EMA), 0.7475 (20-DMA)

Summary: AUD/USD resumes weakness after brief pause on Tuesday's trade. The pair has slipped below 21-EMA and is poised for further downside.