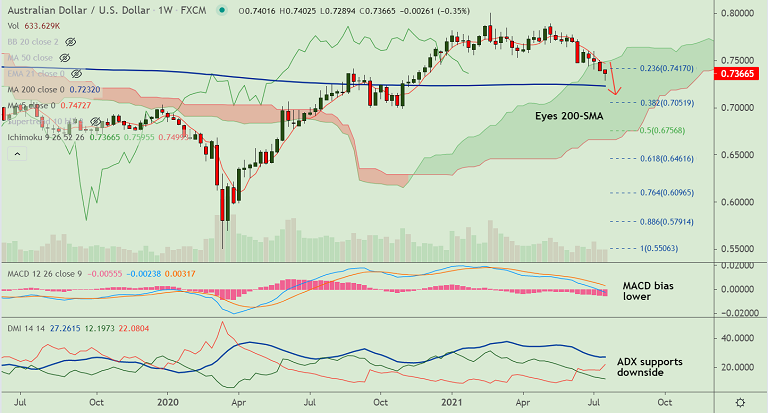

AUD/USD chart - Trading View

Spot Analysis:

AUD/USD was trading 0.39% higher on the day at 0.7384 at around 10:00 GMT.

Previous Week's High/ Low: 0.7503/ 0.7392

Previous Session's High/ Low: 0.7362/ 0.7289

Fundamental Overview:

The Australian dollar finds some buying interest amid improved risk sentiment which was evidenced by a generally positive tone around the equity markets.

That said, investor's concerns about the potential economic fallout from the spread of the highly contagious Delta variant of the coronavirus keep upside in check.

Further, escalating US-China tussles as US Trade Representative Katherine Tai backs Australia in its trade dispute with China dent antipodeans.

Technical Analysis:

- Analysis of GMMA indicator show major and minor trend are bearish

- Price action is below cloud and major moving averages

- MACD and ADX support weakness in the pair

- Hammer formation on the weekly candle till date raises scope for upside

Major Support and Resistance Levels:

Support - 0.7232 (200-week MA), Resistance - 0.7406 (200H MA)

Summary: Price action is inching closer towards 200H MA, decisive break above will boost further gains. Major trend is bearish, decisive breakout above 200-DMA will change near-term dynamics.