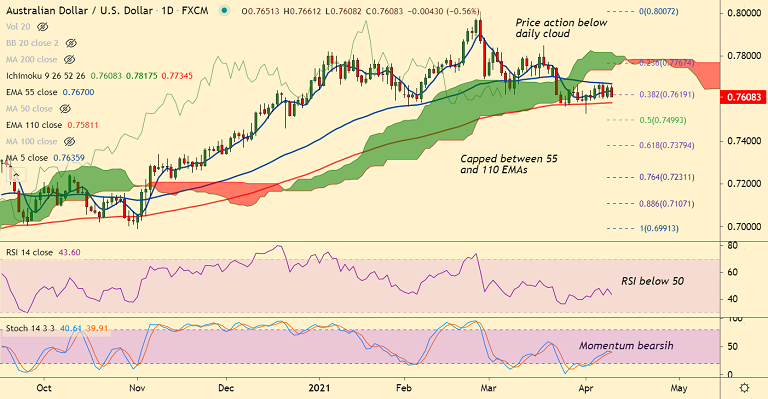

AUD/USD chart - Trading View

Spot Analysis:

Intraday High/Low: 0.7661/ 0.7610

Previous Day's High/Low: 0.7660/ 0.7602

Previous Week's High/Low: 0.7664/ 0.7531

Technical Analysis: Bias Neutral

GMMA Indicator - Neutral

ADX Indicator - Neutral

Oscillators: In neutral zone

Ichimoku Cloud Analysis: Price action below cloud, Chikou span biased lower

Bollinger Bands: Volatility is high

Daily Support/Resistance Levels:

Support: 0.76, 0.7581 (110-EMA), 0.7523 (Lower BB)

Resistance: 0.7636 (5-DMA), 0.7656 (21-EMA), 0.7670 (55-EMA)

Summary: The pair trades directionless, technical indicators do not provide a clear directional bias. Price action is capped between 55 and 110 EMAs. Breakout will provide a clear directional bias. Focus on U.S. PPI data for impetus.