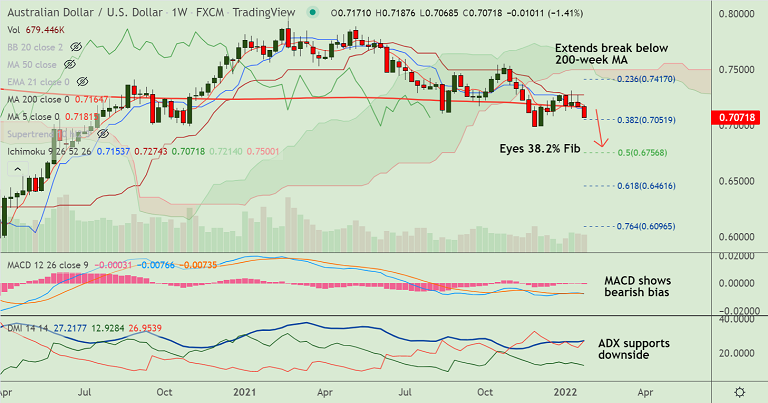

Chart - Courtesy Trading View

AUD/USD was trading 0.26% lower on the day at 0.7095 at around 10:20 GMT.

The pair is on track to close below 200-week MA which will reinforce further downside.

Momentum is strongly bearish. Stochs and RSI are sharply lower, RSI is well below the 50 mark.

Strong US dollar gains post-FOMC meeting continue to exert downside pressure on the pair.

As widely anticipated, the Fed left rates and taper unchanged, while chairperson Jerome Powell signalled plans to steadily tighten policy.

The statement indicates that “ the Committee expects it will soon be appropriate to raise the target range for the federal funds rate.”

Further, rising investor concerns over political tensions between Russia and Ukraine exacerbated worries for the antipodeans.

AUD/USD trades below 200-week MA and is on track to test 38.2% Fib at 0.7051. Break below to see more weakness.