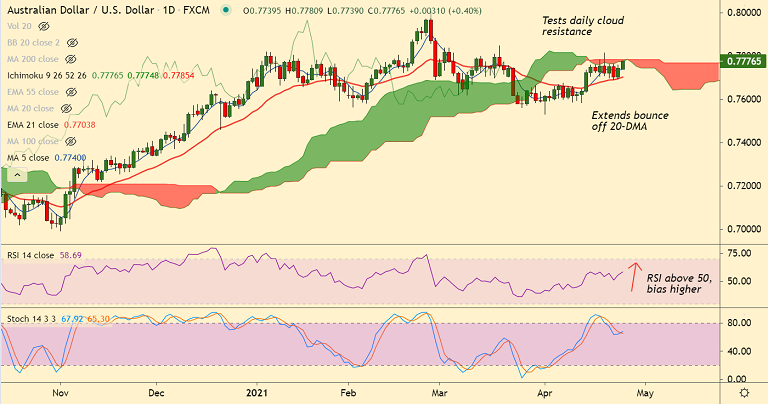

AUD/USD chart - Trading View

AUD/USD was trading 0.36% higher on the day at 0.7774 at around 05:20 GMT, bias higher.

The pair has opened the week on a bullish note and is extending Friday's gains. Scope for further gains.

An improved market mood and broad-based US dollar weakness in supporting the pair higher.

Price action is extending bounce off 20-DMA. 21W EMA also offers strong support. Any weakness only on break below.

Volatility is rising. Momentum studies are bullish. RSI is well above the 50 mark and biased higher.

Price action is currently testing resistance at daily cloud. Decisive break above will buoy bulls. Major resistances lies at 0.78, 0.7947, 0.80, 0.8259.

On the flipside, major supports align at 21-EMA at 0.7703 ahead of 110-EMA at 0.7606 and 200-DMA at 0.7443.

Summary: Watch out for break above daily cloud for upside continuation. Scope for retest of 0.80 mark.