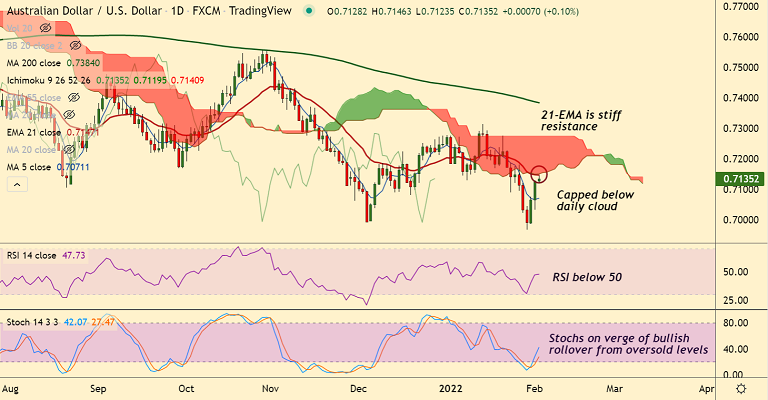

Chart - Courtesy Trading View

AUD/USD was trading 0.07% higher on the day at 0.7132 at around 08:30 GMT.

The pair has slipped lower from session highs at 0.7146 after RBA Lowe's cautious comments.

Reserve Bank of Australia (RBA) Governor Phillip Lowe reiterated that the end of bond purchase program does not mean a cash rate rise is imminent.

Lowe also states, “Too early to conclude inflation is sustainably within target range."

Risk appetite remained firm despite mixed comments from the US Federal Reserve (Fed) officials overnight keeping downside in the pair limited.

Focus today will be on US ADP Employment Change for January along with risk catalysts for impetus.

Technical bias for the pair is turning bullish on the intraday charts. Price action has edged above 200H MA.

The pair is testing stiff resistance at 21-EMA and daily cloud. Break above will propel the pair higher. Next major resistance lies at 55-EMA at 0.7193.