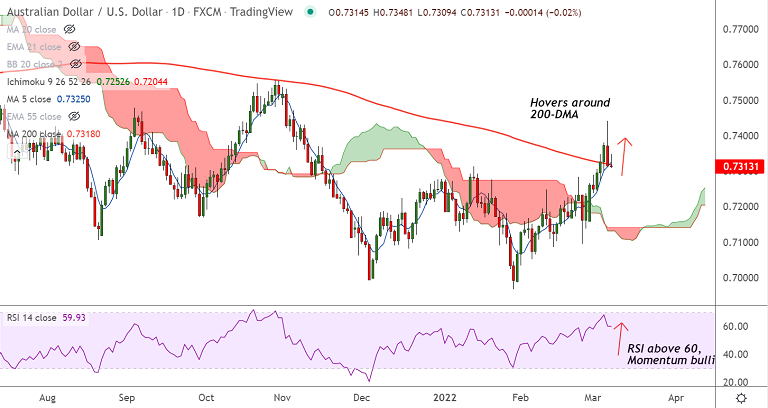

Chart - Courtesy Trading View

AUD/USD was trading 0.05% lower on the day at 0.7310 at around 04:45 GMT.

The pair has erased early gains and slipped lower from session highs at 0.7348.

Price action hovers around 200-DMA and daily close below will negate any further upside.

On the data front, Australia’s NAB Business Confidence, Business Conditions improved in February.

However, souring market mood amid little progress in the peace talks between Ukraine and Russia dent the antipodeans.

Reserve Bank of Australia (RBA) Governor Philip Lowe's speech will be eyed amid a broad push to dump the “wait-and-watch” approach of the Aussie central bank.

Technical bias for the pair remains bullish. Major moving averages are trending higher.

That said, RSI and Stochs are showing a bearish rollover from overbought levels, raising scope for some weakness.

Summary: AUD/USD close below 200-DMA will see dip till next major support at 110-EMA at 0.7242. Bounce off 200-DMA will see upside resumption.