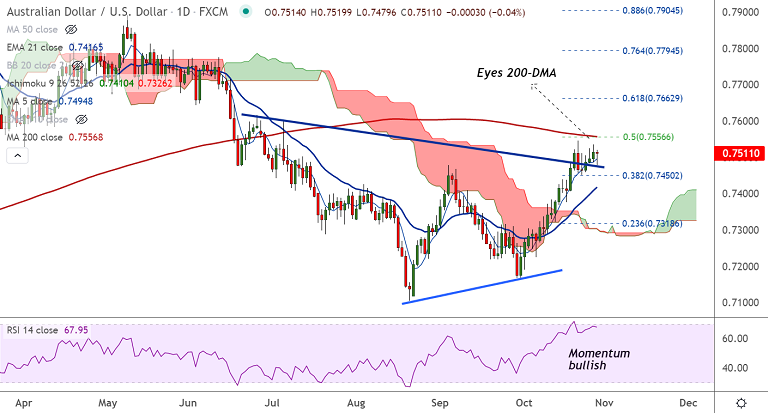

AUD/USD chart - Trading View

AUD/USD was trading 0.12% higher on the day at 0.7523 at around 07:45 GMT, outlook bullish.

The pair is grinding higher for the 4th straight session, erases early losses and edges higher from session lows at 0.7479.

The pair attracted some dip-buying at lows around 0.7479, amid rising bets for a rate hike move by the Reserve Bank of Australia (RBA).

Wednesday's release of RBA trimmed mean inflation for the third quarter, which indicated that consumer cost pressures are getting entrenched, stoked rate hike speculations.

AUD/USD is consolidating break above major trendline resistance. Momentum is bullish, MACD and ADX support gains.

Major Support Levels:

S1: 0.7496 (5-DMA)

S2: 0.7480 (Trendline)

S3: 0.7417 (21-EMA)

Major Resistance Levels:

R1: 0.7556 (200-DMA)

R2: 0.7575 (Upper BB)

R3: 0.76

Summary: AUD/USD poised for further gains. Test of 200-DMA at 0.7556 on cards.