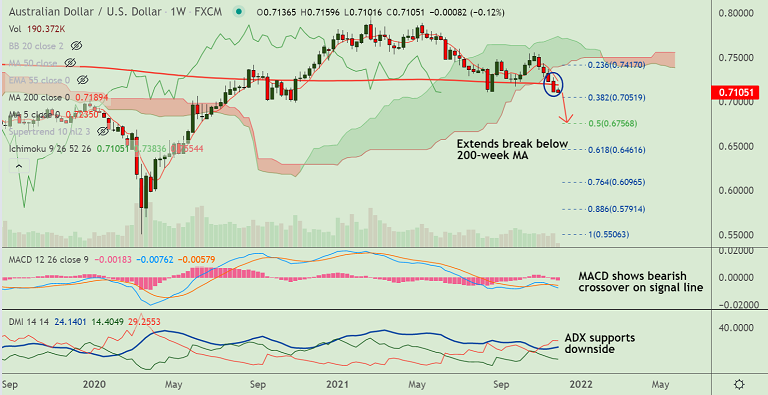

Chart - Courtesy Trading View

News:

Moderna’s Chief Executive Stéphane Bancel predicts existing vaccines will struggle with Omicron - Financial Times (FT) reports.

"The high number of Omicron mutations on the spike protein, which the virus uses to infect human cells, and the rapid spread of the variant in South Africa, suggested the current crop of vaccines may need to be modified next year." notes Bancel

Technical Analysis: Bias Bearish

GMMA Indicator

- Shows strong bearish bias on near and long term moving averages

Ichimoku Analysis

- Price action is well below daily cloud

- The pair is extending break below weekly cloud

Oscillators

- Stochs and RSI show strong bearish momentum

- Oscillators are at oversold, but no signs of reversal seen

Bollinger Bands

- Bollinger bands are spread wide apart and are showing signs of further widening

- Volatility is hence high and rising, likely to add fuel to the downside momentum

Major Support Levels: 0.7080 (Lower BB), 0.7051 (38.2% Fib)

Major Resistance Levels: 0.7147 (5-DMA), 0.7189 (200-week MA)

Summary: AUD/USD set to see further weakness, scope for test of 0.7051.