We would like to be firm in predicting the bearish trend for AUDUSD in future, however short term rallies are to be prolonging for some more time but the current upswings may prolong maximum up to 0.7262 or even up to 0.7412 levels. On monthly and weekly charts, prices remained well below moving average curve despite these sharp bounces. RSI is also converging upwards with every price spikes.

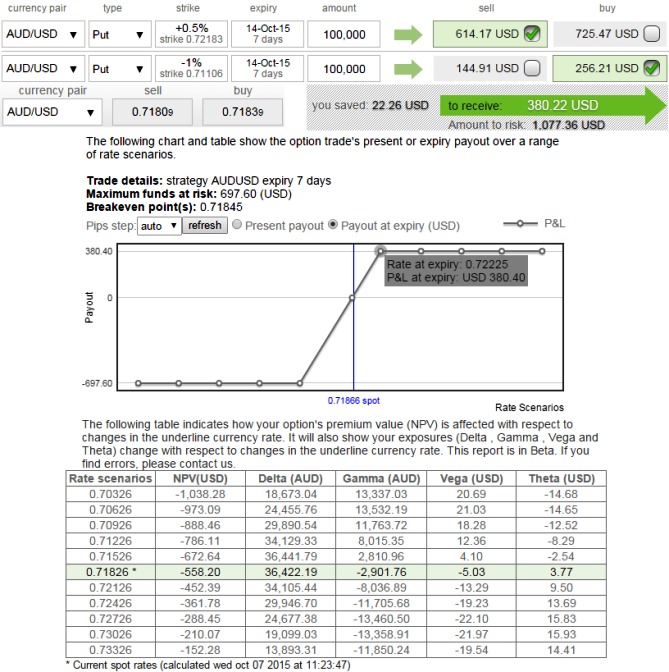

Considering the prevailing short term uptrend, on a hedging perspective, credit put spreads are desirable. The delta is positive and included between 0 and +1 because the position is bullish.

We recommend buying -1M 1% out of the money puts and sell 1% in the money put option of shorter expiry (preferably 3D or 1W). If the pair closes above the higher strike price on expiration date, both options expire worthless and the bull put spread option strategy earns the maximum profit which is equal to the credit taken in when entering the position.

The Delta is at its highest speed when the underlying exchange rate falls between the two strike prices.

A high speed delta reflects a situation of uncertainty and, consequently, a higher risk. In fact, the highest is the delta speed of options, the more dependent from the underlying price it becomes. That is why each single dollar of movement in the stock involves a highest changing of the option price.

In such a situation, the position may move dramatically involving a high degree of risk for the trader becoming either profitable or unprofitable with a small changing in the underlying exchange price.

Conversely, a low speed delta may reflect a relative situation of calmness and a lower risk for the trader. In such context, the option position is less dependent from the price of the underlying and it is unlikely to move considerably if conditions do not change.

FxWirePro: AUD/USD delta put spread allows participating in short term uptrend

Wednesday, October 7, 2015 6:44 AM UTC

Editor's Picks

- Market Data

Most Popular

FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate