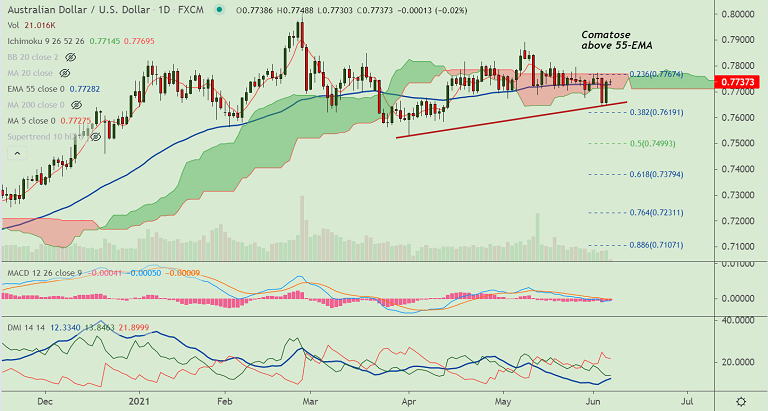

AUD/USD chart - Trading View

AUD/USD struggles to extend previous session's gains, was trading largely unchanged on the day at 0.7739 at around 05:00 GMT.

Aussie remains depressed after downbeat China trade data. Spiking covid cases in Victoria counters S&P’s upgrade to the country’s outlook.

China's Trade Balance for May, in Yuan terms, came in at CNY296 billion versus CNY330.98 expectations and CNY276.5billion last.

Details of the report showed exports surged 39.5% last month vs. 22.2% previous. While, imports rose by 18.1% vs. 32.1% expected and 32.2% prior.

In USD terms, Trade Balance came in at +45.53B versus +50.5B expected and +42.85B previous, with imports and exports both missing estimates.

Moody’s Investors Service in its review on the Chinese economy, underscored the concerns over the post-pandemic recovery, further denting sentiment.

Major Support Levels:

S1: 0.7728 (55-EMA)

S2: 0.7667 (110-EMA)

S3: 0.7590 (Lower W BB)

Major Resistance Levels:

R1: 0.7745 (20-DMA)

R2: 0.7769 (cloud top)

R3: 0.78 (psychological mark)

Summary: AUD/USD trades with a neutral bias. The pair was trading largely rangebound on the day with session high at 0.7748 and low at 0.7730. Technical indicators do not provide a clear direction. Breakout above cloud will fuel further gains. On the flipside, decisive break below 110-EMA will drag prices lower.