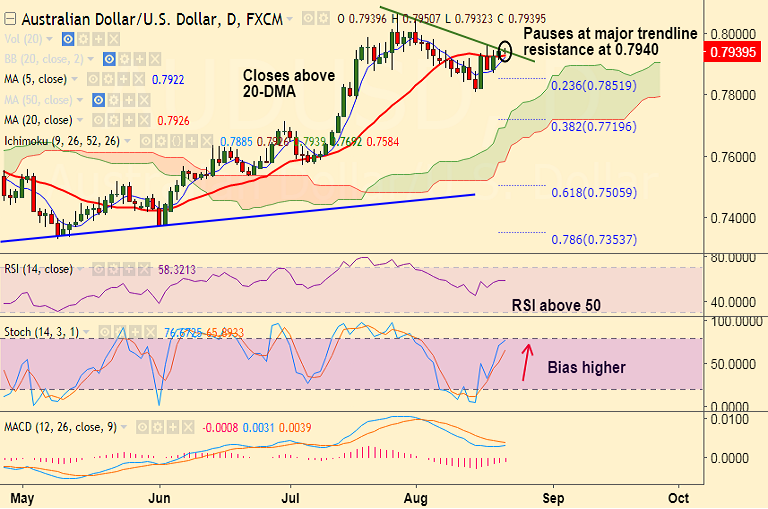

- AUD/USD has closed past 20-DMA resistance at 0.7925 on Monday's trade, bias higher.

- Upside is now pausing at major trendline resistance at 0.7940. Break above will see resumption of upside.

- Technical indicators are bullish. RSI holds above 50 level and Stochs are biased higher. MACD is also showing upside bias.

- The pair is trading in a rising channel pattern. Scope now for test of 0.80 levels. Violation there could see test of 0.8090 (channel top).

- On the flipside, close below 5-DMA at 0.7922 will negate upside bias, raising scope for test of lower Bollinger Band at 0.7926.

Support levels - 0.79, 0.7894 (5-DMA), 0.7851 (23.6% Fib retrace of 0.7160 to 0.8065 rally)

Resistance levels - 0.7962 (Aug 17 high), 0.80, 0.8042 (Aug 1 high)

Call update: Our previous call (http://www.econotimes.com/FxWirePro-AUD-USD-struggles-at-20-DMA-good-to-go-long-on-break-above-860753) is progressing well.

Recommendation: Bias higher, stay long.

FxWirePro launches Absolute Return Managed Program. For more details, visit http://www.fxwirepro.com/invest