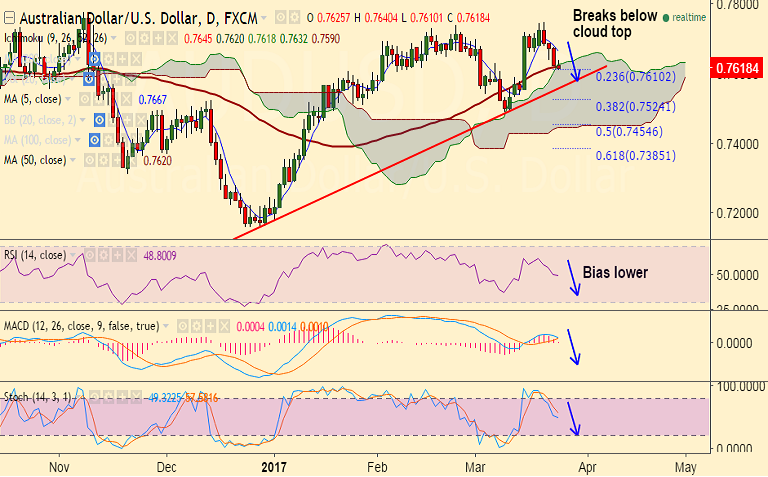

- AUD/USD is extending downside for the 4th consecutive session, bias lower.

- The pair has broken below daily cloud top at 0.7625 and has breached 50-DMA support at 0.7620.

- Downside is holding immediate support at 0.7610 (23.6% Fib retrace of 0.7160 to 0.7749 rally).

- Technical studies are bearish, RSI and Stochs are biased lower and MACD is on the verge of a bearish crossover.

- We see scope for test of trendline support at 0.7560, further weakness only on break below.

Support levels - 0.7610 (23.6% Fib retrace of 0.7160 to 0.7749 rally), 0.7560 (trendline), 0.7545 (200-DMA)

Resistance levels - 0.7625 (cloud top), 0.7662 (5-DMA), 0.77, 0.7732 (Feb 16 high)

Call update: Our previous call (http://www.econotimes.com/FxWirePro-AUD-USD-finds-strong-support-at-07628-20-DMA-good-to-short-break-below-602966) is progressing well.

Recommendation: Stay short for targets.

FxWirePro Currency Strength Index: FxWirePro's Hourly AUD Spot Index was at -65.3811(Bearish), while Hourly USD Spot Index was at 72.692 (Bullish) at 0520 GMT. For more details on FxWirePro's Currency Strength Index, visit http://www.fxwirepro.com/currencyindex.