Technical Analysis:

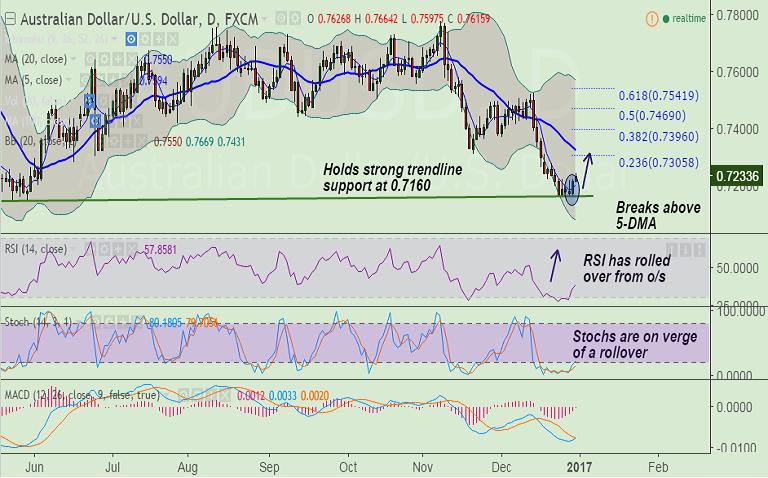

- AUD/USD is extending bullish momentum after break of 5-DMA at 0.7186 on Thursday.

- Major trendline support seen at 0.7160, weakness only on break below.

- RSI has shown a rollover from oversold levels. Stochs are at oversold and on verge of rollover.

- Price action moving away from lower bollinger band.

Fundamental Factors:

- Investors unwinding their USD longs heading into the New Year holiday-break.

- Rising commodities’ prices, particularly oil, copper and gold support the resource-linked Aussie.

- Australian private sector credit data which was inline with expectations offers fresh impetus.

Important Levels:

- Support: 0.7199 (5-DMA), 0.7160 (major trendline), 0.7148 (May 30 low)

- Resistance: 0.7258 (Dec 22 high), 0.7305 (23.6% Fib), 0.7325 (20-DMA)

Call Update:

- We had advised a long in our previous call (http://www.econotimes.com/FxWirePro-Watchout-for-AUD-USD-close-above-5-DMA-at-07185-for-upside-potential-467668).

- Target price 1 hit. We see scope for upside.

Recommendation: Book partial profits at highs. Hold for further gains.

FxWirePro Currency Strenght Index: FxWirePro's Hourly AUD Spot Index was at 92.6627(Highly bullish), while Hourly USD Spot Index was at -106.452 (Highly bearish) at 0500 GMT. For more details on FxWirePro's Currency Strength Index, visit http://www.fxwirepro.com/currencyindex.

FxWirePro: AUD/USD breaks above 5-DMA, bias higher, stay long

Friday, December 30, 2016 5:11 AM UTC

Editor's Picks

- Market Data

Most Popular