As has been the pattern this year, AUDUSD has taken another shift lower in the trading range. Accordingly, some sensible adjustments are made to the previous forecast track for the currency-cross, more so, to mark-to-market recent developments (in particular, a tightening in EM financial conditions). AUDUSD is now forecasted at USD 0.70 by year end, and 0.68 by mid-2019. The US growth continuing to outperform, consequently, the Fed’s intend to adjust the higher real rates intact and slower Chinese growth expected in 2019 there is scope to be more bearish on AUDUSD.

The Aussie’s mid-August slide to 0.72 on Turkey-inspired global risk aversion still left it quite fragile.

Still, AUD risks probably remain to the downside in September (0.70 handle), given the confluence of FOMC meeting, US review of China tariffs and EUR/Italy budget risks.

Bearish AUDUSD scenarios below 0.70, given:

1) The unemployment rate moves back towards 5.75%, raising the spectre of RBA rate cuts;

2) The Fed responds to firm labour market outcomes and above trend growth by delivering a faster pace of hikes than currently expected;

3) China data weaken materially; or

4) The risk markets retrace and vol rises as trade war fears escalate.

OTC outlook and Hedging Perspectives (AUDUSD):

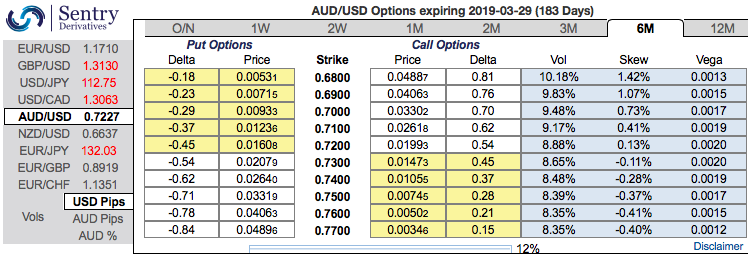

Before proceed further into the strategic framework, let’s quickly glance through the positively skewed IVs of 6m tenors signify the hedgers’ interests to bid OTM put strikes upto 0.68 levels (above nutshell). While bearish delta risk reversal across all tenors also substantiate that the hedging activities for the downside risks.

Accordingly, we have advocated delta longs for long term on hedging grounds, more number of longs comprising of ITM instruments and capitalizing on prevailing rallies and shrinking IVs in 1w tenors, theta shorts in short-term to optimize the strategy (as shown below).

The execution of hedging strategy: Short 1m (1%) OTM put option with positive theta (position seems good even if the underlying spot goes either sideways or spikes mildly), simultaneously, add long in 2 lots of delta long in 6m (1%) ITM -0.79 delta put options. A move towards the ATM territory increases the Vega, Gamma and Delta which boosts premium.

Since the trend of this pair has been drifting in range as you can see the rectangular area on daily plotting of above technical charts and such price behaviour has been prolonged from last 4-6 weeks, theta shorts in OTM put option have gone worthless and the premiums received from this leg is sure profit.

We would like to uphold the same option strategy as stated above on hedging grounds. Thereby, deep in the money put option with a very strong delta will move in tandem with the underlying.

Currency Strength Index: FxWirePro's hourly AUD spot index is inching towards -120 levels (which is bearish), while hourly USD spot index was at 85 (bullish) while articulating (at 10:14 GMT). For more details on the index, please refer below weblink:

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts