AUDUSD’s negative momentum remains strong, the 0.7500 area vulnerable to giving way. All eyes will be on the US payrolls data tonight, markets believing it would take a major disappointment to dent the likelihood of a Fed hike on 15 Dec.

AUDUSD in the medium term perspectives: Lower to 0.7400. The Fed’s assertive tightening bias plus US fiscal expansion should maintain upside pressure on US interest rates and the US dollar. Against that coal and iron ore are likely to sustain a good portion of their dramatic rises, and economic data for Q4 and Q1 should improve, but these forces are subservient to the US dollar’s trend. Australia’s AAA rating will remain an issue into the May budget.

See bearish AUDUSD below 0.73 if:

1) The labor market weakens forcing the RBA to respond more aggressively to weak inflation;

2) The Fed responds to animal spirits and bullish survey data by delivering a faster pace of hikes than currently expected;

3) Trade tensions and capital outflows force genuine CNY devaluation.

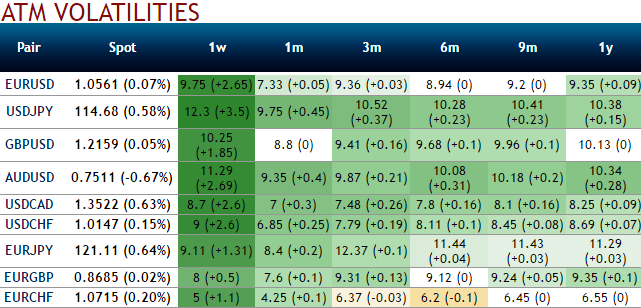

Accordingly, OTC hedging arrangements for downside risks seems intact, you could make this out from the above nutshell evidencing risk reversals, while IVs are spiking higher which is in tandem with the above mentioned underlying forecasts and its rationale.

Please be informed that the nutshell showing negative risk reversals are bids for the hedging for the downside risks, as a result, puts are on more demands over calls. The negative risk reversals across all tenors are indicating the bearish hedging interests.

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady

Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady  RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says

RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary