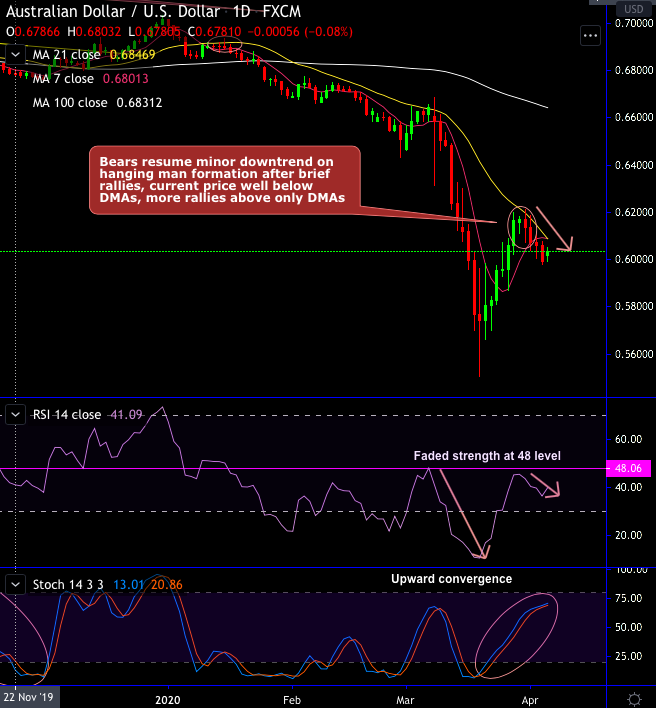

AUDUSD short-term trend: The pair has formed hanging man pattern at peaks of rallies at 0.6168 levels (refer daily chart). Consequently, bears resume the minor downtrend upon this bearish formation after brief rallies, the current price is well below DMAs, more rallies above DMAs.

It retains downside momentum, 0.5980 vulnerable today. Although pair shows brief recovery at this juncture, deep slumps below DMAs and hanging man coupled with faded strength signalled by RSI in addition alerts resumption of the minor downtrend.

The medium term perspectives: 7 & 21-EMAs cap any attempts of upswings, while bears drag price slumps on the breakdown below double top neckline (refer monthly chart).

Both RSI & stochastic curves show downward convergence to the current downswings to indicate the intensified selling momentum. To substantiate this bearish stance, bearish DMA & MACD crossovers indicate the downswings to prolong further.

As a result, the major downtrend remains intact as both leading & lagging indicators are bearish bias on this timeframe as well.

The Aussie dollar, as a proxy for the global risk sentiment, and also for China’s growth outlook amid contagious coronavirus outbreak, will continue to remain under downward pressure. The next major technical support level is 0.5800 (2002 peak).

Trade tips: On trading perspective, contemplating above technical rationale, at spot reference: 0.6036 levels, it is advisable to execute tunnel options strategy with upper strikes at 0.6088 and lower strikes at 0.5980 levels, thereby, one can fetch certain yields as long as the underlying spot FX keeps dipping but remain above lower strikes on the expiration.

Alternatively, on hedging grounds we advocated shorting futures contracts of mid-month tenors, we wish to uphold the same strategy as the underlying spot FX likely to target southwards below 0.58 levels in the medium run. Writers in a futures contract are expected to maintain margins in order to open and maintain a short futures position.