Chart - Courtesy Trading View

Federal Reserve minutes reinforced fears that U.S. rates would be raised higher for longer. Dollar spiked overnight, but has eased from some of the stellar gains.

The interest rate swap and futures markets now have 25 bp hikes for the next three FOMC meetings in March, May and June.

Data on Thursday showed Australian business investment rose to a seven-year high in Q4, pointing to a still healthy expansion in the economy late last year.

Australia private capital expenditure data showed growth of 2.2% q/q, more than the 1.0% forecast. The prior quarter was also revised up to 0.6% from -0.6%

The yield on Australia's three-year bonds rose 5 basis points to 3.606%, while the 10-year yields were also up 5 bps to 3.903%.

Looking ahead, US GDP data will be keenly watched by the market for further impetus.

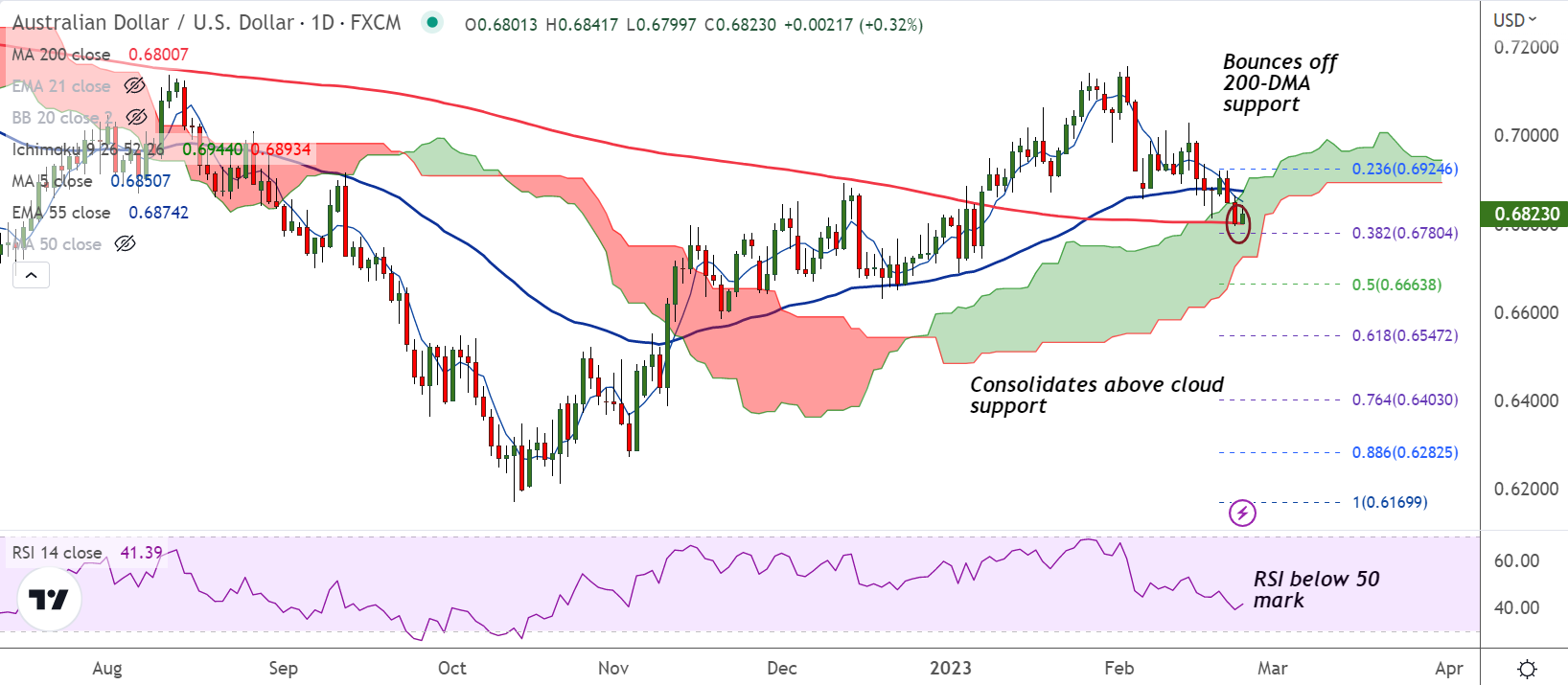

Technical Analysis:

- AUD/USD has bounced off 200-DMA support, weakness only on break below

- GMMA indicator shows minor trend is bearish, while major trend is neutral

- Momentum is bearish, Stochs and RSI are biased lower, RSI is below 50 mark

- MACD and ADX support downside in the pair, Chikou span is biased lower

Major Support Levels: 0.6800 (200-DMA), 0.6763 (Lower BB)

Major Resistance Levels: 0.6826 (110-EMA), 0.6874 (55-EMA)

Summary: AUD/USD has paused downside at 200-DMA. Technical bias still remains bearish. Watch out for break below 200-DMA for further downside. On the flip side, retrace above cloud will negate any near-term weakness.