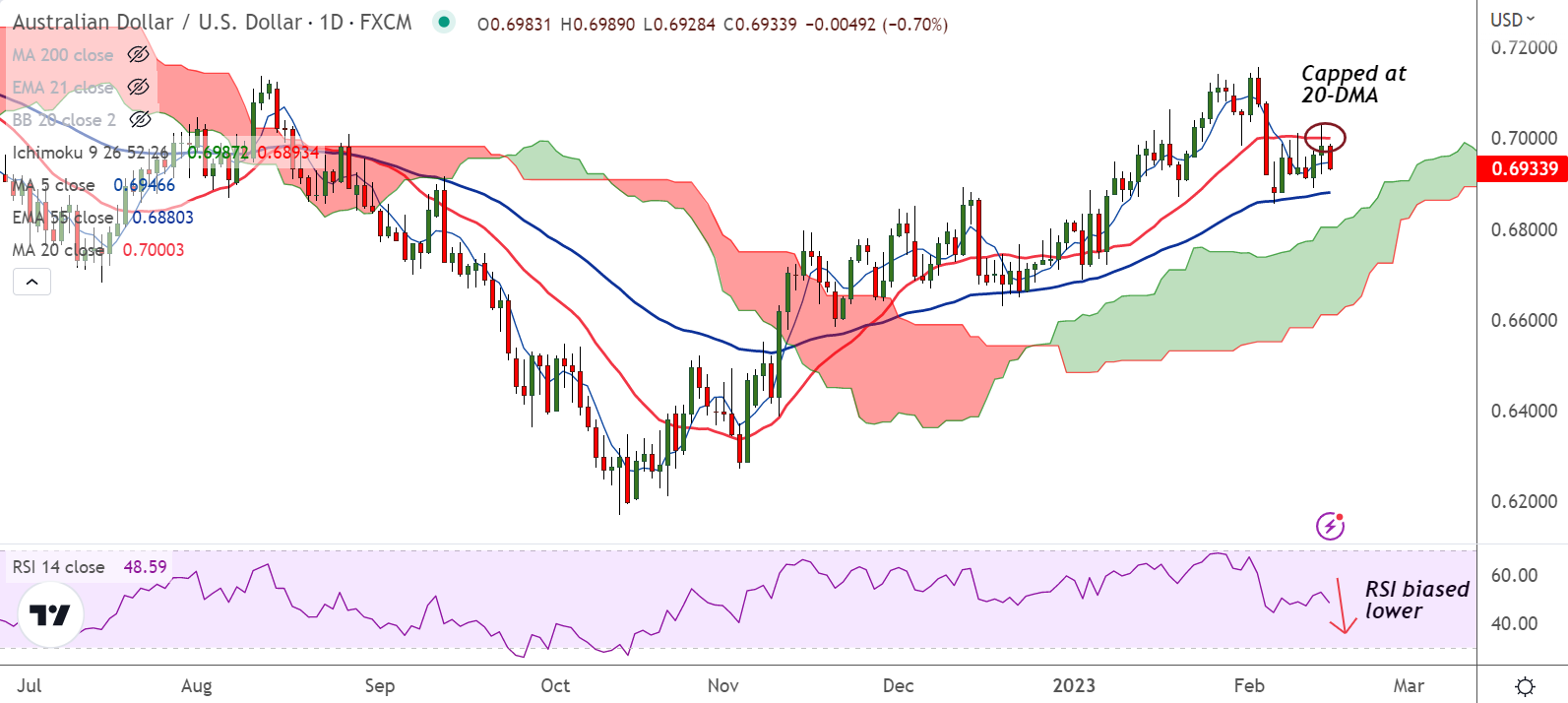

Chart - Courtesy Trading View

Spot Analysis:

AUD/USD was trading 0.72% lower on the day at 0.6933 at around 06:00 GMT.

Previous Week's High/ Low: 0.7011/ 0.6855

Previous Session's High/ Low: 0.7029/ 0.6921

Fundamental Overview:

Antipodeans lost ground on Wednesday as the risk of higher U.S. interest rates for longer weighed on risk sentiment.

Mixed U.S. inflation data released on Wednesday is expected to give the Federal Reserve more impetus to keep raising interest rates which could have a ripple effect on inflation and eventually economic growth.

Further, the RBA's recent hawkish turn suggests the cash rate, which is currently at 3.35%, will peak around 4.20% compared to 3.60% a month ago.

"We now expect the RBA to lift the cash rate 25 bps (basis points) at its next three meetings with a final 25 bps hike in August, taking the terminal cash rate to 4.35%," expect analysts at TD Securities.

Australia's economy is set for a sharp slowdown this year due to high inflation and as the effects of steep interest rate hikes through 2022 begin to be felt.

The Reserve Bank warned of such a scenario during its February meeting, and said that the path to achieving a “soft landing” for the Australian economy was narrowing.

The RBA hiked rates by a cumulative 325 basis points from record lows. But the hikes have so far had a limited impact on inflation, with price pressures trending at over 30-year highs.

Technical Analysis:

- AUD/USD pullback from multi-month high has held support at 55-EMA

- Momentum is bearish, RSI is biased lower and below the 50 mark

- MACD supports downside in the pair, Chikou span is biased lower

- Recovery attempts are capped at 20-DMA, Price action has slipped below 200H MA

Major Support and Resistance Levels:

Support - 0.6880 (55-EMA), Resistance - 0.7000 (20-DMA)

Summary: AUD/USD trades with a bearish technical bias. Price action remains capped between 20-DMA and 55-EMA. Break out of range will provide clear direction.