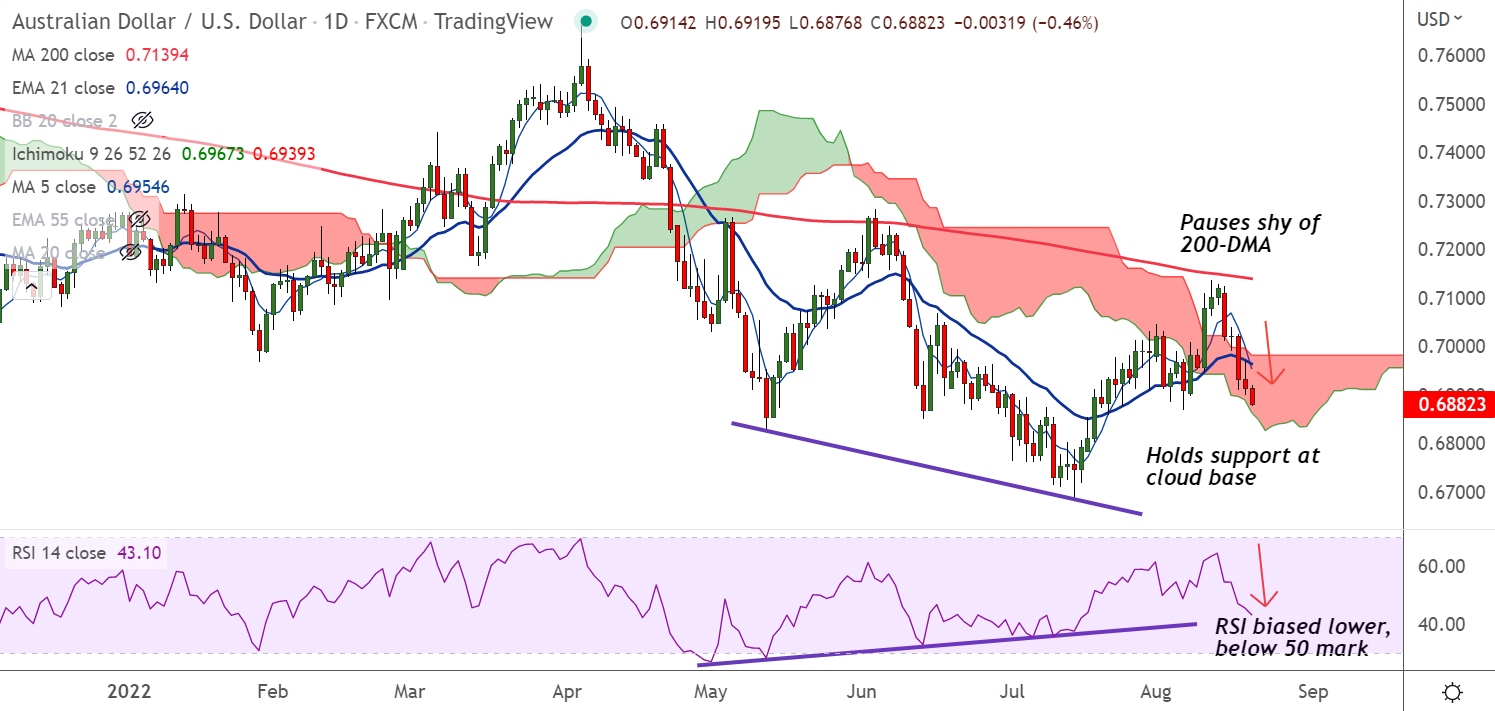

Chart - Courtesy Trading View

Technical Analysis:

- AUD/USD was trading 0.31% lower on the day at 0.6893 at around 11:30

- The pair has shown a decisive break below 50-DMA and is testing cloud base support

- Price action has failed to extend break above daily cloud

- Momentum is with the bears, Stochs and RSI are sharply lower

- MACD shows bearish crossover on signal line, ADX supports downside

- Chikou span is biased lower, the pair is on verge of break below cloud

- GMMA indicator shows major trend is neutral while minor trend has turned bearish

Support levels - 0.6855 (Lower BB), 0.6681 (July 2022 low)

Resistance levels - 0.6953 (5-DMA), 0.7013 (200H MA)

Summary: AUD/USD trades with a bearish bias. Break below daily cloud will plummet prices.